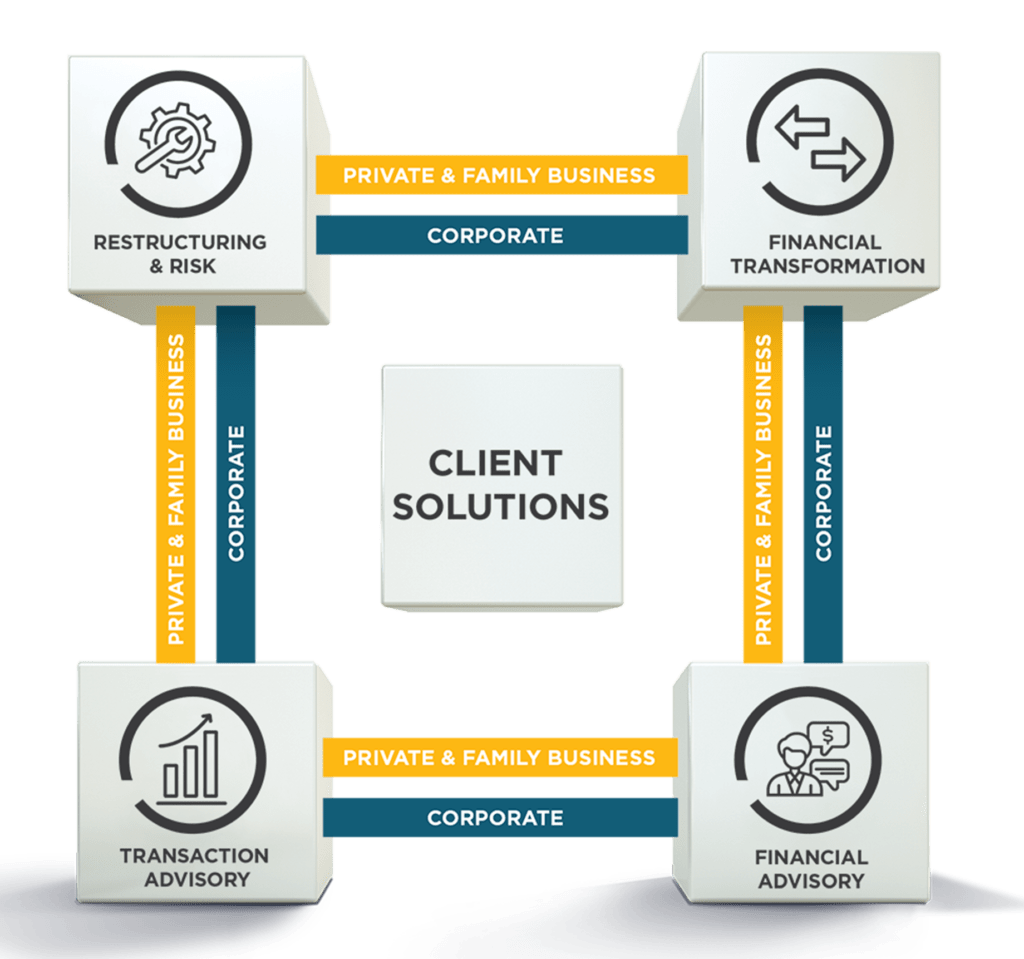

Transaction Advisory

We work in partnership to enhance stakeholder value by identifying, evaluating, negotiating and executing strategic transaction opportunities including:

- Due diligence reviews

- Share and business valuations

- Preparing independent expert reports

- Mergers and acquisitions

- Divestments

- Management buyouts/buyins.

We also have extensive experience in assisting with capital market transactions, sourcing debt and equity funding and the formation of joint ventures and strategic alliances.

Financial Advisory

- Share and equity valuations

- Business valuations

- Tax valuations

- Litigation, dispute and expert opinions

- Debt Advisory

- Raising capital

- Financial model preparation and review

- Cashflow and forecast models

Financial Transformation

- Strategic planning – developing your roadmap for the future

- Process improvement – giving you back time through process efficiency

- Reporting packs – ensuring you get the right information with time to act

- Business performance improvement – gathering insights and acting on them

- Sales readiness – working with you to make your business more saleable

- Cloud accounting support – unlocking efficiencies and saving valuable time.

Restructuring & Risk

- Debtor assessment and process improvement reviews

- Business performance reviews

- Debt/equity structuring

- Refinancing options and financial forecasting reviews

- Planning and implementing business restructures and integrations

- Business sale and acquisition advice

- Cost reduction and product profitability analysis

- Informal work-outs

- Financial and operation risk assessments

- Private equity transactions

- Pre-lending reviews and investigating accountant’s reports for financiers

- Solvent winding up and distribution of assets

- Solvency and operational reviews

- Voluntary administrations and liquidations.