It is that time of the year again when finance teams and auditors brace themselves for the busy months ahead.

While there are a few financial reporting developments that could impact entities for 30 June 2022, some entities will have very little (maybe even no) change to deal with this financial reporting period, while others will have to deal with the move from special purpose financial statements (SPFS) to general purpose financial statements (GPFS), which could involve a fair amount of effort. And somewhere in between are those entities that will have to tweak their disclosures as they adopt the new Tier 2 Simplified Disclosures framework that replaces the now-withdrawn Reduced Disclosures Requirements (or RDR) framework. To assist clients in navigating the financial reporting landscape for this reporting season, some of the key changes and considerations are summarised below, with links included to helpful resources where applicable.

Transitioning from SPSFS to GPFS for the first time

The biggest change many for-profit entities will have to deal with this reporting season is making the mandatory change from GPFS to SPFS.

Entities impacted by the removal of SPFS are those required by:

- legislation (e.g. the Corporations Act) to prepare financial statements that comply with Australian Accounting Standards or ‘accounting standards’; or

- a constituting (e.g. trust deed) or other document (e.g. loan agreement) created or amended on or after 1 July 2021 that includes, or retains, a requirement to prepare financial statements that comply with Australian Accounting Standards.

It is unlikely that affected entities will have public accountability (as defined in AASB 1053) therefore it will be appropriate for these entities to prepare GPFS under the new Tier 2 Simplified Disclosures framework.

Applying this framework means compliance with the recognition and measurement requirements of the accounting standards that are relevant to the entity, including those relating to consolidation and equity accounting. In terms of disclosures, Tier 2 entities must refer to AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities for their presentation and disclosure requirements.

One presentation matter to take note of is that entities do not have to present a statement of changes in equity where the only changes in equity during the periods presented arise from profit or loss, payment of dividends, corrections of prior period errors and changes in accounting policy. In these circumstances, the entity can present a single statement of income and retained earnings.

Entities that have to migrate from SPFS to GPFS should not assume that this is purely a disclosure exercise. The transition effort required will depend on the degree to which an entity currently complies with the recognition and measurement provisions in Australian Accounting Standards, as well as the existing level of disclosures it makes in its SPFS.

Furthermore, there is limited transitional relief available to entities that are making the mandatory change form SPFS to GPFS for the first time this year. This means these entities will have to restate comparatives (where necessary to ‘fix’ the numbers), as well as include prior year information in any new notes required under Tier 2 disclosure requirements. There is, however, no need to distinguish between prior year errors and changes in accounting policies in the year of transition. Instead, these can all be shown as transitional adjustments if the entity so chooses.

Entities are also reminded to update the basis of preparation note in their financial reports to reflect the correct financial reporting framework, which in this case is ‘Australian Accounting Standards – Simplified Disclosures’.

Financial reporting focus areas

Directors and preparers are reminded of the areas they should be particularly mindful of when it comes to pulling their financial reports together. The Australian Securities and Investments Commission (ASIC) recently issued its focus areas for 30 June 2022 financial reports, urging directors and preparers to ensure such reports provide useful and meaningful information for users during a time when many entities are confronted with challenging market conditions and uncertainties. The key areas ASIC has highlighted are as follows:

- asset values

- provisions

- going concern and solvency assessments

- subsequent events

- disclosures in the financial report and the Operating and Financial Review (OFR)

The above areas are largely consistent with those emphasised in previous periods. While COVID-19 may continue to impact businesses, albeit to a lesser degree to that in previous years, ASIC reminds entities there is a host of other evolving circumstances, uncertainties and risks that could affect an entity’s performance, the value of its asset and provisions as well its business strategies. Things to consider include (but are not limited to):

- COVID-19 conditions and restrictions

- Discontinuation of financial and other support from governments, lenders and lessors

- Oil price increases

- Availability of skilled staff and expertise

- Changes in customer preferences and behaviours

- Government commitment on policies on climate and carbon emissions

- the Ukraine/ Russia conflict

- Legislative and regulatory changes

- Use of technology to hold meetings and work from home

- Rising interest rates and the impact on future cash flows and discount rates

- Technological changes and innovation

- Other economic and market developments

A significant section of the media announcement is dedicated to the OFR. It is ASIC’s expectation that the OFR clearly explains the underlying drivers of the entity’s results and financial position, as well as risks, strategies and future prospects. It should also complement the financial report and narrate how the entity’s business has been impacted by any of the changing circumstances listed above. Furthermore, there is an emphasis on talking about environmental, social and governance risks that are significant or important to the entity, their potential impact and how management can mitigate these risks. ASIC also reminds directors to consider the recommendations of the Task Force on Climate-related Financial Disclosures where climate poses a significant risk to the business that could impact its future prospects.

For more information on the focus areas, refer to ASIC’s media announcement.

As a reminder, ASIC’s focus areas should continue to be considered in conjunction with its COVID-19 Financial Reporting FAQs which address a host of financial reporting and audit matters that are updated as new issues emerge.

Disclosures of business risks and asset values

As part of ASIC’s latest financial reporting surveillance program, it reviewed the financial reports of 70 listed entities for the year ended 31 December 2021. This process resulted in ‘please-explain’ letters being sent to the directors of 18 entities on 31 accounting-related matters.

The OFR has clearly become one of ASIC’s focal points as about a third of the issues queried related to the OFR. Coming in a close second, with seven queries, was impairment and asset values. Provisions, revenue recognition, non-IFRS profits, going concern and leases all tied for third with each giving rise to two queries.

ASIC’s media release highlights the need for directors to ensure their OFRs are balanced in terms of narrative by not only talking about the entity’s strategies and future prospects, but also about the material business risks that could impede these.

ASIC continues to find shortcomings in the application of the accounting requirements when it comes to the recoverability of assets (such as goodwill, intangibles and property, plant and equipment). Directors are reminded that the cash flows and assumptions that underly impairment calculations must be reasonable and supportable against historical trading results and current and expected future market conditions. Calculations, judgements and assumptions, and appropriate supporting data, should be documented well enough to withstand the scrutiny of auditors and regulators. And of course, significant estimation uncertainties, key assumptions (and changes therein) as well as sensitivity analysis must make their way into financial reports to ensure robust impairment disclosures.

SaaS arrangements

Software-as-a-Service (SaaS) arrangements became a hot topic last year after the IFRS Interpretations Committee (IFRIC) issued guidance in the form of an agenda decision that clarified how to account for certain costs to implement these cloud-based software arrangements. This brought to light an earlier agenda decision (issued in 2019) that clarified the accounting for the SaaS arrangements themselves.

The March 2019 agenda decision explains that a customer that contracts to pay a fee in exchange for a right to receive access to a supplier’s application software running on the supplier’s cloud infrastructure does not give rise to a lease nor does it give rise to a software intangible asset. Instead, such an arrangement is accounted for as a service contract whereby the expense is recognised as the service is received.

The April 2021 agenda decision goes on to clarify how a customer accounts for costs (specifically configuration and customisation costs) to implement a SaaS arrangement envisaged in the 2019 agenda decision. There are a few decision points entities will have to consider in the context of their specific facts and circumstances to arrive at the appropriate accounting treatment, but very often, such configuration and customisation costs have to be expensed.

While these two agenda decisions have been around for a while now, they may have been missed last year. In this case, entities should pay attention to software intangible assets that exist as at 30 June 2022 and make sure they understand what costs have been capitalised to arrive at those balances. Where the costs are similar to those covered in the two agenda decisions discussed above, it is likely that an adjustment will be needed to write off costs incorrectly capitalised. If costs capitalised in prior years are material, comparatives will have to be restated and appropriate disclosures included in the current year financial report. For a detailed analysis of the agenda decisions and their accounting implications, refer to our article on the topic.

Charity-specific changes

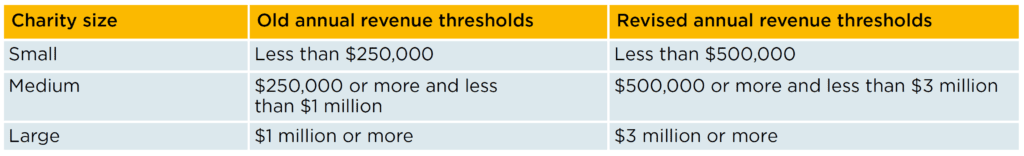

Charities that are registered with the Australian Charities and Not-for-profits Commission (ACNC) have revised revenue thresholds to consider this year when determining their size as either small, medium or large, as indicated in the following table:

Large charities that prepare SPFS and have more than one remunerated key management personnel (KMP) also have additional disclosures to include in their 30 June 2022 special purpose reports. The newly required KMP compensation disclosures must be made under either AASB 124 Related Parties or AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities (paragraphs 193 to 196).

For 2022 reporting periods, affected charities do not have to (but can choose to) provide comparative numbers in the KMP remuneration disclosures, but must do so from 2023 onwards. For more detailed guidance on the above changes that affect ACNC-registered charities, refer to our article published earlier this year.

This article was first published in The Bottom Line, issue 13.