Software-as-a-Service (SaaS) – or cloud-based software – is fast becoming mainstream. As entities move away from on-premise software to SaaS arrangements, they should be mindful of the accounting implications. To this end, it is helpful to consider the two agenda decisions issued by the IFRS Interpretations Committee (IFRIC) relating to SaaS arrangements.

SaaS is a way to deliver software services to customers through the internet meaning customers can access data from any device as long as it has an internet connection. In this web-based model, software suppliers host and maintain (i.e. control) the servers, databases and the code that makes up the application.

SaaS arrangements differ from traditional on-premises software in the following ways:

- The software is not installed or stored on the customer’s computer systems

- The SaaS services and infrastructure are managed by the SaaS supplier and shared by many customers

- Customisation of the SaaS services is limited

- SaaS services are typically paid for on a subscription basis

With this is mind, let’s consider the accounting treatment of SaaS arrangements by reference to the two agenda decisions issued by the IFRIC.

Software asset or service?

The March 2019 agenda decision considers how to account for a SaaS cloud computing arrangement in which the customer contracts to pay a fee in exchange for a right to receive access to the supplier’s application software for a specified term. The question that arises here is whether the customer receives a software asset at the commencement of the contract or a service over the period of the contract.

A customer receives a software asset at the contract commencement date if either:

(a) the contract contains a software lease; or

(b) the customer otherwise obtains control of the software at the contract commencement date.

For a lease to exist, a contract must convey the right to control the use of an identified asset. For such a right to exist, a customer must have both:

- the right to obtain substantially all the economic benefits from use of the identified asset; and

- the right to direct the use of the asset (i.e. the customer can direct how and for what purpose the asset is used).

A cloud-based software arrangement generally does not give rise to a lease under IFRS / AASB 16 Leases. This is because a right to receive future access to the supplier’s software running on the supplier’s cloud infrastructure does not in itself give the customer any decision-making rights about how and for what purpose the software is used.

In assessing whether the customer obtains control of a software asset at contract commencement date, the requirements of IAS 38 / AASB 138 Intangible Assets need to be considered. For an intangible asset to be recognised, the ‘identifiability’ and ‘control’ criteria must be met.

A right to receive future access to the supplier’s software does not give the customer the power to obtain the future economic benefits flowing from the software itself and to restrict others’ access to those benefits. Therefore, SaaS arrangements usually do not give rise to an intangible asset.

In conclusion, where a SaaS arrangement does not give rise to a software lease nor does it give rise to an intangible asset that the entity controls, then the right to access the supplier’s application software in the future is a service contract. The customer recognises the expenditure for the service (being access to the software) as the services are received. If the customer pays the supplier before it receives the service, an asset is recognised for the prepayment representing the customer’s right to future services.

Configuration and customisation costs

Building on the earlier agenda decision discussed above, the April 2021 agenda decision considers how to account for costs incurred to configure or customise a supplier’s application software in a SaaS arrangement.

In the scenario presented to the IFRIC, the supplier (and not the customer) controls the cloud application software to which the customer has access (so the same kind of service arrangement present in the March 2019 agenda decision). Configuration and customisation are specifically described in the fact pattern: configuration involves the setting of various flags or switches within the application software, or defining values or parameters, to set up the software’s existing code to function in a specified way; customisation involves modifying the software code in the application or writing additional code.

The assessment of whether configuration or customisation of cloud-based software results in an intangible asset depends on the nature and output of the configuration or customisation performed.

Intangible asset not recognised

Where a customer does not control the software being configured or customised, the customer would not recognise an intangible asset for the costs it incurs. This is because such costs do not create a resource controlled by the customer that is separate from the supplier’s software hosted in the cloud.

In this scenario, the costs would be expensed when the customer receives the configuration or customisation services. Under IAS 38 / AASB 138, services are received when they are performed by a supplier in accordance with a contract to deliver them to the entity, and not when the entity uses them to deliver another service. This means the costs are expensed as the service is received and not when the customer accesses the SaaS arrangement to which the configuration and customisation services relate.

The IFRIC agenda decision goes on to explain that IAS 38 / AASB 138 provides no guidance on how to identify the services that the customer receives and when the supplier performs those services. It is therefore appropriate to draw guidance from IFRS / AASB 15 Revenue from Contracts with Customers that deals with similar and related issues.

Applying AASB 15

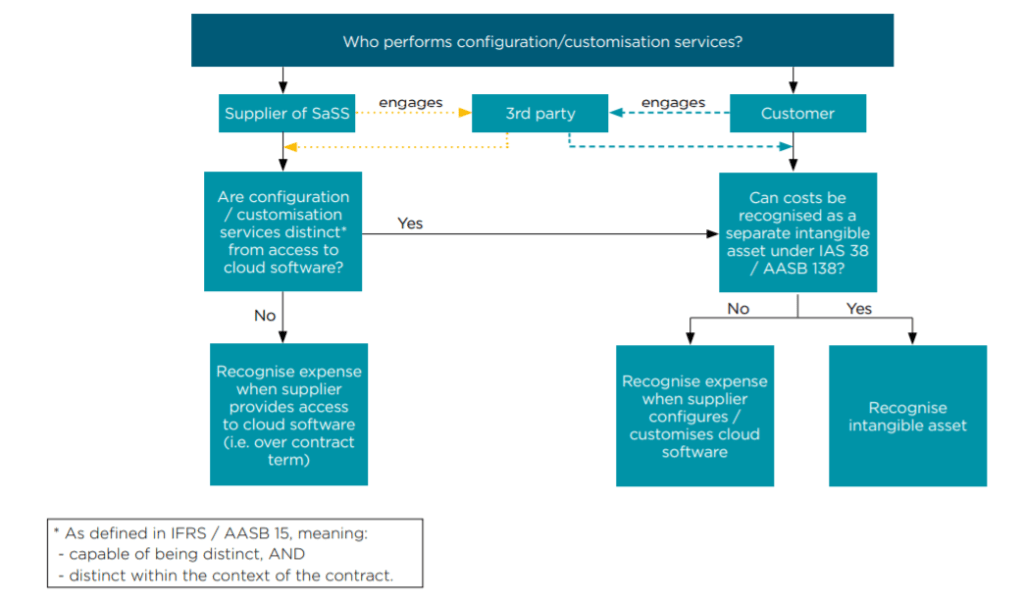

In situations where the supplier of the cloud software (or a third party contracted by the supplier) also provides the configuration or customisation services, the customer determines when it receives those services as follows:

- if the configurations or customisation services are distinct, then the customer recognises the costs as an expense when the supplier configures or customises the application software.

- if the configurations or customisation services are not distinct (because those services are not separately identifiable from the customer’s right

to receive access to the supplier’s application software), then the customer recognises the costs as an expense when the supplier provides access to the application software over the contract term.

For those situations where the customer engages a third party to supply the configuration or customisation services, the costs are recognised as an expense when the third-party supplier configures or customises the application software.

Entities may encounter difficulties assessing whether the configuration or customisation services performed by the supplier are distinct from the right to access the supplier’s cloud software over the term of the contract. The guidance in IFRS / AASB 15 states that a good or service promised in a contract is distinct if both the following criteria are met:

- the customer can benefit from the good or service either on its own, or together with other resources that are readily available to the customer; and

- the entity’s promise to transfer the good or service to the customer is separately identifiable from other promises in the contract.

Applying the first criterion to the scenario under discussion, indicators that the configuration or customisation services are distinct would be if such services are provided separately by other suppliers, or if the customer could use the SaaS application software without the configuration or customisation services.

On the other hand, if these services require the supplier to significantly modify (customise) its own cloud-based software so that it functions together with the customer’s existing infrastructure, it may be appropriate to conclude that the customisation service is not distinct on the basis that what is being promised by the supplier is a fully-integrated system.

That is, the promises to provide the customisation service and access to the cloud-based software are not separately identifiable (second criterion above).

Intangible asset recognised

It may be the case that a SaaS arrangement results in the customer modifying its own existing software or creating new software that it owns and controls, for example, to allow for entity-specific functionality of the supplier’s cloud software, or to enable the customer’s on-premise applications to interface with the supplier’s cloud-based applications. In these situations, it is likely that a separate intangible asset can be recognised for certain costs under the requirements of IAS 38 / AASB 138, remembering that costs related to research and training, as well as indirect costs and general overheads cannot be capitalised as part of an intangible asset.

Decision tree illustrating application of April 2021 agenda decision

What do agenda decisions mean for entities?

The existence of agenda decisions is not well known outside of the accounting technical community, but they can prove to be quite helpful if you know they are there. The IFRIC deliberates IFRS application issues from IFRS users world-wide. It then decides whether to recommend standard setting to address these issues. Where the IFRIC decides that standard setting is not required to address a specific issue (because IFRS provides adequate guidance), the basis for such a decision needs to be communicated to the public. This is where agenda decisions come in: they explain the basis of not recommending standard setting for the issues rejected by the IFRIC and aim to improve the consistency of IFRS application.

Entities that claim compliance with IFRS need to follow the guidance in agenda decisions (since agenda decisions derive their authority from IFRS itself). Here in Australia, Tier 1 and Tier 2 entities are required to comply with all the recognition and measurement requirements of Australian Accounting Standards (AAS), which are equivalent to IFRS. As such, Australian entities complying with all AAS need to align their accounting practices with those endorsed by the IFRIC via the agenda decisions.

Where an entity’s current accounting practice needs to change because of an agenda decision, this constitutes a change in accounting policy. Such changes are generally accounted for retrospectively, meaning numbers reported in previous periods would need to be restated where the changes are material.

Specific disclosures are required for changes in accounting policies. Agenda decisions do not have effective dates. The expectation is that entities adopt the changes stemming from agenda decisions in a timely manner, meaning entities should evaluate the impact of relevant agenda decisions and reflect any required changes in their financial statements as soon as possible.

Considering ASIC’s explicit reference to the April 2021 agenda decision in its recent announcement of the focus areas for the upcoming June reporting season, entities should ensure they have appropriately considered the impact of this on their 30 June 2021 financial statements and made any necessary adjustments and disclosures. Entities are encouraged to reach out to their auditors if they need assistance in this regard.

This article was first published in The Bottom Line Issue 10