The revenue thresholds that determine a charity’s size have officially been increased, but so too have the disclosure requirements relating to key management personnel (KMP) remuneration and related parties to improve accountability and transparency in the sector.

Highlights

- The revenue thresholds that determine a charity’s size have significantly increased with effect from the 2021-22 financial year.

- Large charities that prepare special purpose financial reports will be required to disclose KMP remuneration for the 2021-22 financial year and beyond.

- Medium and large charities that prepare special purpose financial reports will be required to disclose details of related party transactions for years ending 30 June 2023 and thereafter.

The detail

Increased size thresholds

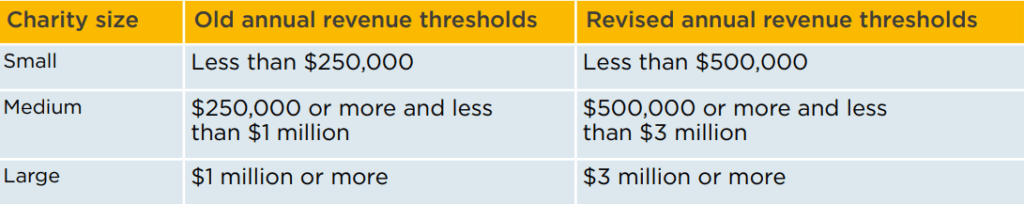

To give effect to Recommendation 12 of the Australian Charities and Not-for-profits Commission (ACNC) Legislative Review, the financial reporting thresholds that determine the size of a charity registered with the ACNC as small, medium or large have increased as follows:

The revised revenue thresholds are effective for financial years ending on 30 June 2022 and later. In other words, charities will use the revised thresholds when submitting their 2022 and later Annual Information Statements and financial reports.

The increased reporting thresholds will mean that some charities will migrate from being a large charity to a medium charity. These charities will then have the option to have their financial reports reviewed rather than audited.

Those charities that will be classified as small, and no longer medium, under the changed thresholds will no longer have to prepare and lodge financial statements with the ACNC. Instead, they will just be required to submit an Annual Information Statement.

While these reforms can save time, effort and money, charities should be mindful of the benefits that an independent audit or review can bring to the table, such as bolstering the entity’s credentials in the eyes of key stakeholders.

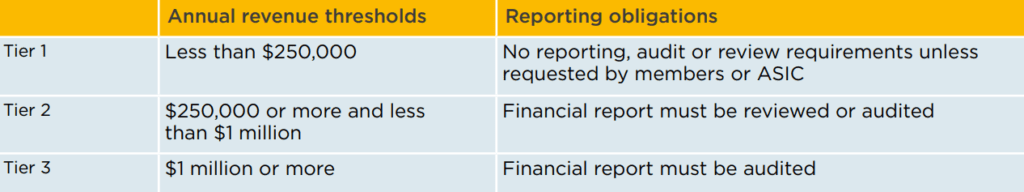

It should be noted that the revenue thresholds that apply to companies limited by guarantee (CLG) that are not ACNC-registered charities, as set out in the Corporations Act 2001, have not been changed. There appears to be no immediate intention to align these thresholds with the revised charity thresholds. As a reminder, the revenue thresholds that apply to CLGs under the Corporations Act 2001 are as follows:

Related party disclosures

Charities that prepare general purpose financial statements (GPFS) are required to include the related party disclosures under either AASB 124 Related Parties (Tier 1 entities) or AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities (Tier 2 entities).

However, charities currently preparing special purpose financial statements under the ACNC Act are not required to disclose transactions with related parties. This is because these charities only have to comply with the five mandatory accounting standards, being:

- AASB 101 Presentation of Financial Statements

- AASB 107 Statement of Cash Flows

- AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors

- AASB 1048 Interpretation of Standards; and

- AASB 1054 Australian Additional Disclosures.

Under the changes to the Australian Charities and Not-for-profits Commission Regulation 2013 (Regulations), AASB 124 has now been added as a mandatory accounting standard that medium and large charities will have to comply with when preparing special purpose financial reports. For these charities, the Regulations allow a choice to apply all the disclosure requirements of the now six mandatory standards, or the equivalent disclosure requirements contained in AASB 1060.

With respect to related party disclosures other than KMP remuneration, the disclosure requirements in AASB 124 and AASB 1060 are essentially the same.

Entities that choose to present the disclosures under the Simplified Disclosure requirements contained in AASB 1060 are also required to make the special purpose disclosures required by paragraphs 1 to 6, 9, 9A, 9B and 17 of AASB 1054.

As a result of the changes to the Regulations, medium and large registered charities that prepare special purpose financial reports will be required to disclose details of related party transactions in financial statements for years ending on 30 June 2023 and thereafter.

The later effective date will allow charities some time to implement processes and systems to capture related party transactions for reporting purposes.

KMP remuneration

KMP are defined as “the people with authority and responsibility for planning, directing and controlling the activities of an entity, directly or indirectly, including any director (whether executive or otherwise) of that entity.”

In a charity context, KMP would refer to responsible persons (such as its directors, board or committee members, or trustees) and senior executives (such as the Chief Executive Officer or General Manager, the Chief Financial Officer and the Chief Operations Officer).

KMP might be employed directly by a charity. Remuneration includes all forms of consideration paid, payable or provided by, or on behalf of, a charity, in exchange for services rendered to the charity.

KMP services could be provided to a charity by a separate management entity. KMP remuneration therefore includes amounts incurred for KMP services provided by such a separate management entity.

For years ending 30 June 2022 and later, large charities with two or more KMP that prepare special purpose financial reports will be required to include disclosure of remuneration paid or payable to their KMP as required by either AASB 124 (if applying the six mandatory standards) or AASB 1060 (if applying the equivalent disclosures in AASB 1060).

The disclosures under AASB 124 as they relate to KMP compensation are slightly more onerous than those under AASB 1060 in that they require disaggregation of total KMP remuneration. To address this, it is understood that the ACNC Commissioner intends to exercise discretion and allow large charities with more than one KMP to only disclose the aggregate amount of KMP remuneration for the period, as is permitted by AASB 1060, even where the charity elects to apply AASB 124 and the other five mandatory standards.

Amounts incurred for KMP services provided by a separate management entity will also require disclosure in special purpose financial statements of large charities, irrespective of the number of remunerated KMP. This is done in a separate note in the financial statements.

Large charities must disclose the total amount of KMP remuneration in their Annual Information Statements where they have more than one compensated KMP, or the KMP services are provided by a separate management entity.

Small and medium charities are not required to make the above remuneration disclosures in their special purpose financial reports and Annual Information Statements.

First-time adoption of the new disclosures

In terms of transition, the Regulations do not provide for any relief in the year of adoption of the new disclosures. However, the ACNC Commissioner has exercised discretion and decided that affected charities do not have to provide comparative numbers in the first year of adoption. This applies for related party transactions and KMP compensation disclosures.

This article was first published in The Bottom Line – Issue 12.