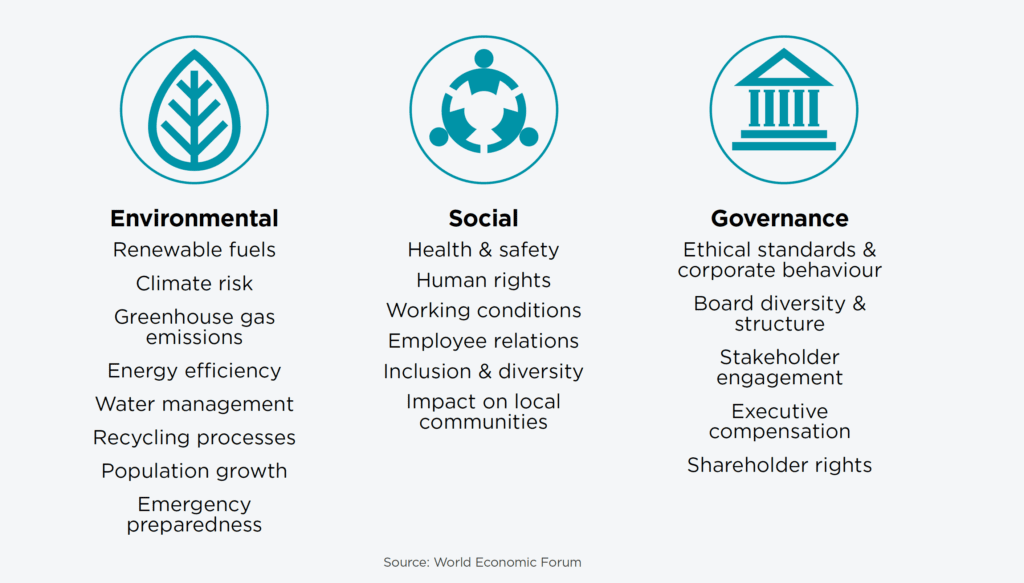

Environmental, Social and Governance (ESG) factors have become increasingly significant with businesses across all sectors recognising their importance in building trust with stakeholders and achieving long term success.

Employees, customers, investors, investment managers, lenders, rating agencies and government regulators are demanding that businesses consider how their operations are combatting issues such as climate change, workplace safety and equal opportunity.

ESG considerations in investment decisions

Lessons learnt

The COVID-19 outbreak has revealed many businesses are both resilient and nimble. They demonstrated they could quickly adapt to new working conditions which were created by the pandemic (i.e. remote working via the greater use of technology, electing to protect jobs through government support, looking after staff and observing health directives). For many this was the first pivot towards an ESG-centric business.

Businesses have also recognised the importance of being genuine and authentic in their dealings with all stakeholders and being more transparent than ever before in how they communicate. These are all valuable lessons which businesses will need to capitalise on and continue to apply.

With increased transparency comes opportunity. An ESG-centric business is likely to attract investors as well as talent. For example, people new to the workforce are seeking to align themselves with companies that support their values. Likewise, investors are increasingly demanding that companies show they are directing funds in ways that protect the environment and communities in which they operate.

What does it all mean?

Being ESG-centric is no longer a choice. It is important that all businesses start to embrace these factors and make the necessary pivot if they are to remain relevant.

Therefore, companies looking to undertake a public listing need to be transparent and clearly communicate the ESG fundamentals that they have applied and/or are intending to apply in their prospectus, as well as being authentic and open in how they deal with their stakeholders.

Currently EU law requires large public companies to disclose information on the way they operate and manage social and environmental challenges. In 2021 a proposal for a Corporate Sustainability Reporting Directive (CSRD) was presented to the EU. If passed the directive will extend sustainability reporting requirements to all large companies and all listed companies. Australian companies should be mindful that this framework will be closely monitored by local regulatory authorities.

While Australia does not have compulsory sustainability reporting, companies are required to disclose any information that shareholders would reasonably need to make informed investment decisions. There are also recommendations on corporate governance practices around environmental and social risks for publicly listed companies in Australia. Common examples of requirements we have seen include meeting stated minimum local content (both materials and labour), the Workplace Gender Equality Act, voluntary compliance with the Modern Slavery Act, having and observing the requirements of a corporate social responsibility framework (CSR).

Steps to be taken

ESG should be considered a cornerstone of the business. It is imperative that businesses take a strategic approach to ESG. Those charged with governance (i.e. the Board of Directors) must consider ESG fundamentals in the company strategy and accept that they are responsible for driving the transition to being more environmentally and socially responsible.

Similar to all other changes implemented by businesses, the process of change will necessarily encompass a detailed analysis to examine the merits of altering the product/service offerings and the process of doing business. This includes processes, operations and supply chain management, level of local content, amongst other factors.

For companies considering listing, the ASX has provided commentary recommendations which refer to a 2015 Guide for Australian Companies, the UN Global Compact Ten Principles and the International Integrated Reporting Council. These should be carefully reviewed by the Board and company advisers.

This article was published in the 2022 IPO Watch Australia Report.