Coinciding with the end of COVID-19 insolvency relief measures, as at 1 January 2021 the Australian Federal Government have introduced new insolvency reforms with the objective of providing a simplified pathway for small businesses to allow faster and lower cost liquidations.

Key takeaways

- Commenced 1 January 2021

- Objective is to reduce costs and time for small businesses

- Extended use of technology for communication and meetings

Small Business Restructuring

- Eligible small business has access to a ‘debtor-in-possession’ style restructuring process (i.e. director/s remain in control)

- Appointment of a ‘small business restructuring practitioner’ (RP)

- Director/s develop a restructuring plan (i.e. debt compromise)

- If plan completed, company is released from its debts and continues to trade

- Faster and less complex process to maximise chance of survival

Simplified Liquidation Process

- Eligible small business has access to a ‘simplified liquidation pathway’

- Director’s lose control of company (as per normal liquidation)

- Appointment of a registered liquidator

- Faster and lower cost liquidation process

Small business restructuring

Eligibility Criteria

- Less than $1M in debts on the day restructuring begins (does not include employee entitlements and contingent liabilities)

- No director (current or in the previous 12 months) or the company has done a restructuring or simplified liquidation in the last 7 years (Exemption: prior restructuring or simplified liquidation must not have begun more than 20 business days prior)

- Tax lodgements, including Superannuation, are up-to-date

- Paid all employee entitlements that are payable (prior to offering restructuring plan)

- Director’s to provide within 5 business days:

- Declaration that the company meets the eligibility criteria

- Whether there are any voidable transactions

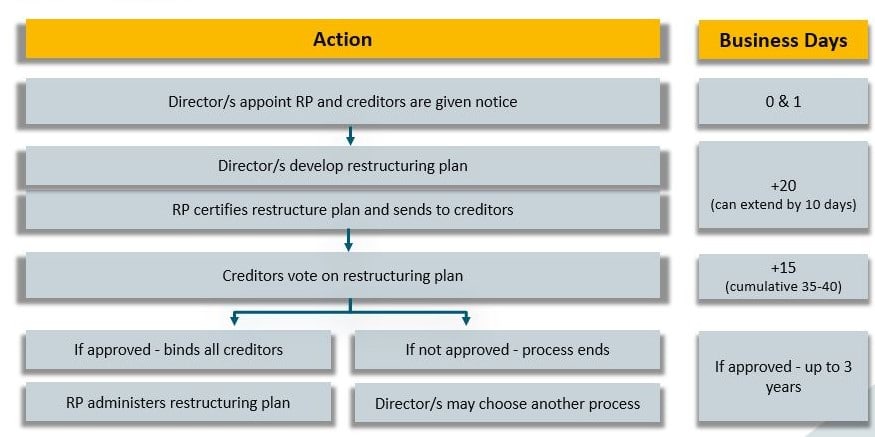

New Process

Key Features

Simplified liquidation process

Eligibility Criteria

- Less than $1M in debts on the day liquidation begins (include amounts for employee termination even if they are yet to be terminated)

- Company is unable to pay its debts in full within 12 months

- Tax lodgements are up-to-date (including superannuation)

- No director (current or in the previous 12 months) or the company has done a restructuring or simplified liquidation in the last seven years

- Director/s to provide within five business days:

- Report on company’s business affairs

- Declaration that company meets the eligibility criteria

New Process

Key Features

Other measures

Accessing Restructuring Relief

- Between 1 January 2021 and 31 March 2021, director must:

- Make a declaration about company’s eligibility for temporary restructuring relief

- Publish notice of declaration on ASIC’s published notice website

Further information

HLB Mann Judd provides tailored restructuring and risk advisory services. Our experienced team has a proven history of successfully assisting our clients through financial and operational difficulties. As a full service national firm, we can provide businesses with comprehensive health checks and tailored strategic financial solutions.