This update provides an overview of personal services income (PSI) PSI rules and the addresses changes in the ATO application of the PSI tests outlined in Tax Ruling 2022/3.

What is Personal Services Income?

PSI is income that is mainly received as a reward for your skills, labour, personal effort or expertise. The ATO defines ‘mainly’ as more than half (50%) of the income received being reward for personal effort and skill. Only individuals can derive PSI, which can be earned directly by a sole trader or indirectly through a personal services entity (PSE), i.e., a company, partnership or trust.

Income is not PSI if it’s mainly generated from the supply and sale of goods, supply and use of income-producing assets, and from the business structure of an entity.

Background of PSI rules

PSI rules are intended to ensure that the individuals who performed the personal services are taxed on this income if the relevant conditions are satisfied. The PSI rules also act to limit the deductions available to PSEs and to individuals. This is to prevent individuals splitting their PSI income to other individuals, and reducing or deferring their tax on personal services income by using interposed entities. If an individual is attributed PSI income, that income will generally give rise to Pay As You Go Withholding tax.

The PSI rules do not apply to individuals in their capacity as employees, however care should be taken to ensure the distinction is made between whether the person is engaged as an employee or independent contractor.

What are the key takeaways from TR 2022/3?

The key takeaways from the recent TR 2022/3 are that we have more detailed guidance on the Commissioner’s view on when the PSI tests are satisfied, and examples 1- 41 of the ruling provide further clarification on circumstances that may not have been previously clear following judicial decisions handed down since 2001.

The guidance contained in TR2022/3 regarding satisfying the Unrelated Clients Test, Employment Test and Business Premises Test are summarised below.

Unrelated clients test

The ruling makes it clear that an entity who has PSI from 2 or more unrelated entities and has made offers or invitations to the public (or section of the public) does not necessarily mean they meet the unrelated clients test. There must be a direct causal effect between the offer made to the public or section of the public and the work obtained from the client. It also confirms that work won via intermediaries (e.g. labour-hire firms, web based recruitment sites) will not meet this condition. The ruling notes that any interested member of the public must be capable of accepting the invitation.

The ruling confirms the Commissioner’s view that word-of-mouth referrals, such as obtaining work by recommendations from a previous client or industry contact, generally will not satisfy this condition.

The ruling leaves little room for doubt that the unrelated clients test will not be met by simply having a website or LinkedIn profile unless it is actually used as a revenue generating tool for the relevant PSI. Care should be taken by the entity to confirm each year whether the PSI was won as a direct result of a public service offering.

Employment test

The ruling is predominantly consistent with superseded rulings, however it provides more guidance on how to calculate the market value amount on single and multiple contracts. It also clarifies the term ‘principal work’ and the examples makes it clear that employees and/or contractors who are engaged to perform administrative tasks and clerical duties will not count towards the employment test as these services are not integral to the principal work.

Business premises test

The ruling clarifies that the entity must do more than merely have a leased premises in its name to meet this test. The premises must be used to produce PSI at all times in the income year and the entity must have exclusive use of the business premises.

Exclusive use will be satisfied where the premises are occupied under ownership or lease, as the legal nature of the proprietary interest which allows the holder to determine who may or may not enter the premises. Therefore, an entity that owns or leases a business premises will generally be considered to have exclusive use.

However, a license where the entity only has a right to use the room where that room can be used by other occupants is not considered to be exclusive possession and will not meet the test. Additionally, a leased premises cannot be jointly leased with another entity on the basis that they share the premises and neither lessee has exclusive use.

To ensure compliance with this test, the arrangement for the use of the business premises used by the PSE should be reviewed prior to self-assessing as a PSB.

The impact of the release of TR 2022/3

The release of TR 2022/3 has provided taxpayers with clearer guidelines on the PSI legislation and outlines the Commissioner views on when the PSI tests are satisfied to assist taxpayers to self-assess as a PSB.

If you are subject to the PSI rules, we recommend speaking to your adviser to review your circumstances with consideration for the updated guidelines to ensure compliance with the PSI legislation.

When do the PSI rules apply?

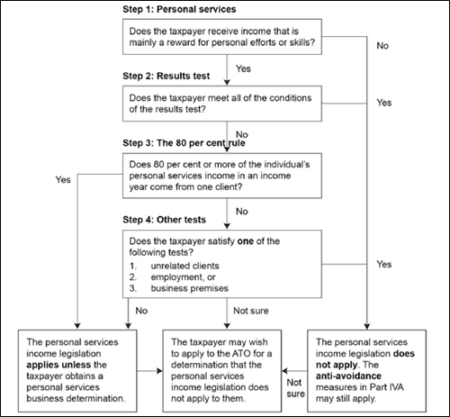

The following diagram demonstrates the operation of the PSI rules and assists in determining whether the PSI rules apply.

Step 1. Personal Services

PSEs can self-assess that it conducts a PSB in relation to each test individual’s PSI in an income year if it either meets the (Step 2) Results Test, or the (Step 3) 80% Rule along with at least one of the (Step 4) Other Tests which are outlined below.

Step 2. Results Test

This test is met if at least 75% of the test individual’s PSI in an income year meets all the following 3 conditions:

- the income is for producing a result;

- the entity is required to supply the plant, equipment and tools of trade needed to undertake the work that produces the result; and

- the entity is, or would be, liable for the cost of rectifying defects.

Step 3. 80% Rule

This test is met if no more than 80% of the test individual’s PSI is from the same entity and its associates.

Step 4. Other Tests

If the 80% Rule is satisfied, the test individual must also satisfy at least one of the following tests:

a) Unrelated Clients

- The unrelated clients test is satisfied in an income year if the entity’s PSI is from producing services to 2 or more entities (who cannot be associates or the individual or PSE); and

- The services must be provided as a direct result of making offers or invitations and those offers must be made to the public at large or a section of the public.

- Examples of direct offers to the public include print advertising, printing posters, radio and television broadcasting, public tender, having a website and posting internet advertisements.

b) Employment

- The employment test is met in an income year if the PSE engages one or more other entities to perform at least 20% (by market value) of the entity’s principal work.

c) Business Premises

- The business premises test is met if throughout the whole income year, the entity maintains and uses a business premises.

- The entity must have exclusive use of the business premises whereby the main activities relating to PSI are conducted.

- It must also be physically separate from any premises used by the service acquirer, or for the entity’s private usage.

On the basis the PSE meets the conditions of Steps 1-4, it can self-assess as a PSB and not apply the PSI legislation.

PSI example

Background Facts

- Mining Co is a private company owned 100% by Peter. Peter is 60 years of age and has extensive experience from being an executive board member and CEO of mining corporations in Australia.

- Mining Co offers consulting services to players in the mining industry and these services are performed by Peter. His clients were sourced by word-of-mouth because of his well-known reputation in the industry.

- Mining Co has a LinkedIn profile and website which are predominantly used to highlight Peter’s career experience and contact details for any interested clients.

- In FY2023 Mining Co received $1m in consulting fees from Client A, and received $400k in consulting fees from the unrelated Client B.

- Peter employs his daughter whose duties are tracking job costings, billing progress payment claims, and contract administration with clients.

- Mining Co licenses the use of a small office space in a commercial building at all times during FY2023 and Peter works in the office 3 days a week and 2 days a week on the client’s premises.

Will the PSI rules apply to Mining Co in FY2023?

Step 1 – Mining Co receives income that is mainly a reward for Peter’s personal efforts and skills as he is performing the consultancy with clients. Proceed to Results Test.

Step 2 – Mining Co is not engaged to produce a result for Client A and Client B. Even if Mining Co supplies its own equipment and is liable for rectifying defects it will not meet the Results Test as all 3 conditions must be satisfied.

Step 3 – Mining Co received 71% of PSI from Client A during the income year, therefore the 80 per cent rule is met. Proceed to Other Tests.

Step 4 – Mining Co does not satisfy the Unrelated Clients Test, Employment Test or Business Premises Test.

- Unrelated Clients Test – Although Client A and Client B are not associates of each other or Mining Co, the consulting services were not provided as a direct result of making offers to the public via their LinkedIn and website. Mining Co is not in a specialised or niche industry so winning work by word-of-mouth does not satisfy this test.

- Employment Test – Peter’s daughter does not have duties that are integral to the principal work of mining consulting and are instead contract administration activities so Mining Co does not satisfy this test.

- Business Premises Test – As Mining Co occupies the business premises by way of a licensing agreement which is not considered to be exclusive use and therefore Mining Co does not satisfy this test.

Conclusion – PSI legislation will apply in FY2023 and the PSI income will be attributed to Peter.

This information is intended as general information only. It has been prepared without taking into account the needs, objectives or financial information of any particular person. Should you wish to learn more about these changes and how they may affect you or your business, please contact your HLB Mann Judd adviser.

This article was co-written by Rachel Freeman and Edgar Gavidia from HLB Mann Judd Sydney.