While terms such as SGE and CbC have become familiar lingo to multinationals in the past four years, the recent changes to the Significant Global Entity definition in May this year has now broadened its application to more taxpayers, but also introduced a new term, ‘CbC RE’, a Country by Country Reporting Entity.

Previously, Australian taxpayers that were ultimately controlled by a group with turnover of greater than $1 billion but did not consolidate into the group accounts, by reason of the investment entity exclusion or materiality, were not SGEs.

As of 1 July 2019, or from 1 January 2020 for substituted accounting periods, Australian taxpayers that fall into this category will now become SGEs and be subject to the significantly increased penalties and anti-avoidance tax laws, such as Diverted Profits Tax and Multinational Anti-Avoidance Law.

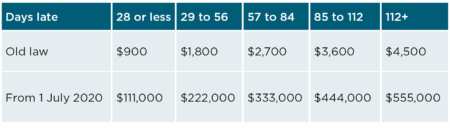

The penalties (outlined in the table) are harsh and in practice are actively pursued by the ATO for the late lodgement of any documents with the ATO (such as income tax returns, Business Activity Statements, FBT). Penalties for new SGEs will be applied for lodgements due after 1 July 2020.

SGEs under the old definition will also be CbC REs under the new law. However, if the Australian taxpayer is an SGE under the new definition because it is ultimately held by an investment entity, such as venture capitalists or private equity, it is not a CbC RE.

Australian taxpayers qualifying as SGEs because they were previously immaterial to the ultimate parent entity’s consolidated accounts will become CBC REs.

CbC REs will be required to prepare and lodge CbC Reporting but also prepare and lodge General Purpose Financial Statements with the ATO if not already lodged with ASIC.

The recent change in SGE law calls for 100 per cent transparency between investor, investees and advisers. Australian taxpayers can find themselves consolidating the financial performance where there are no comparable financial statements, for example, at a private equity fund level.

It seems multinationals have had an uphill battle trying to navigate the ever-evolving tax obligations and guidelines from the OECD and ATO.

Speak with your HLB adviser so that we can assist you on the application of the SGE regime so that you won’t get stung by the ATO later.