Superannuation is the most tax effective place for wealth to be invested in retirement and those who can maximise their allowable tax-free pension cap of $1.9 million should not waste the contribution opportunities available to them.

When super is accumulating income is taxed at 15 percent and capital gains at 10 percent. These tax rates reduce to NIL once the member starts to withdraw a pension.

To maximise the family wealth position, both members of a couple should aim to build a $1.9 million pension balance. This means $3.8 million invested in the tax-free pension environment, providing the couple with access to a tax-free minimum pension of $190,000 a year from age 65.

Building up to a $1.9 million superannuation balance may seem daunting but can be achieved by taking advantage of concessional contribution opportunities in the wealth building years.

Concessional, or tax deductible, contributions include super guarantee or salary sacrifice amounts made by an employer and personal contributions for which a deduction is then claimed in the individuals tax return. These contributions are taxed at 15 percent upon entry into superannuation and may incur an extra 15 percent tax for those whose income and concessional contributions exceed $250,000.

Those with a super balance under $500,000 may also be eligible to carry forward unused concessional contribution limits from the past five financial years. In some cases, this may lead to the ability to contribute and claim a personal tax deduction for up to $157,500.

Building superannuation via concessional contributions is an incredibly tax effective way to accumulate wealth for two key reasons:

- Firstly, they are one of the largest tax deductions available to reduce personal taxable income. Many people think negative gearing is the only way to reduce taxable income.

- Secondly, they boost superannuation savings, meaning a higher retirement income.

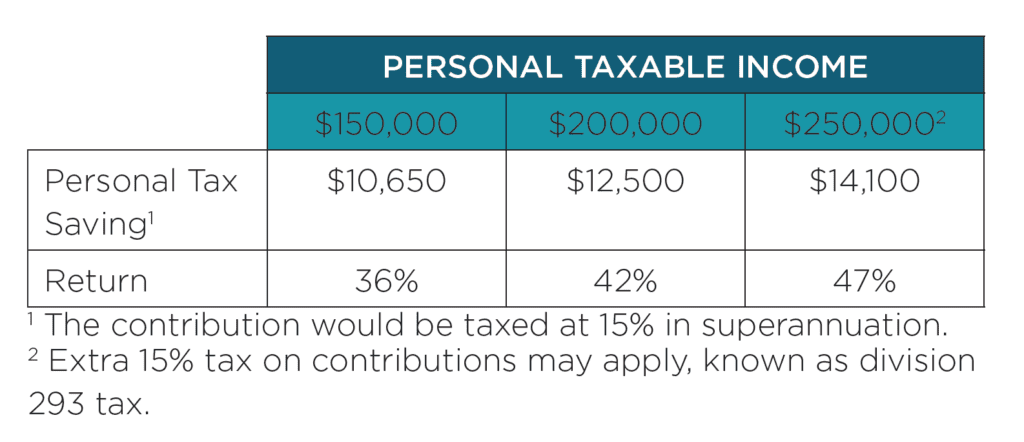

The table below highlights the personal tax saving at different income levels of a $30,000 concessional contribution using the proposed 2024-25 tax rates:

Many people question why they should make extra contributions to superannuation when they could be making extra mortgage repayments. While reducing the home mortgage is an important part of wealth building, extra contributions to super shouldn’t be overlooked as they deliver a better return due to these significant tax savings, as shown in the above table. These returns are much higher than the effective return extra mortgage repayments.

Concessional contributions are also a great way to boost super savings. Take the example of a 40-year-old with a starting super balance of $200,000 and earning a salary of $150,000 a year. If they rely on their super guarantee contributions alone they would have a superannuation balance of $1.37 million by age 65. If instead they make extra contributions and use their full $30,000 concessional limit each year, they would contribute a further $173,000 to super over the next 25 years and boost their earnings by $115,000 taking their balance at age 65 to $1.66 million.

In addition, they would have benefited from the annual tax saving along the way.

Building superannuation via deductible contributions is an incredibly tax effective way to accumulate wealth as they can be the largest tax deduction available to individuals and are an effective way to boost super savings.

Overlooking concessional contribution opportunities in the wealth building years can negatively affect super balances at retirement. The key to building strong super balances is to maximise contribution opportunities and have time on your side by starting early.

Lindzi Caputo is a financial adviser of HLB Mann Judd Wealth Management (NSW) Pty Ltd (AFSL 526052) ABN 65 106 772 696

This article contains general advice which does not consider your particular circumstances. You should seek advice from HLB Mann Judd Wealth Management (NSW) who can consider if the strategies and products are right for you.