In the accounting world, this is a common question. Fortunately, recent amendments to the accounting standard dealing with business combinations, namely AASB 3, should go some way in easing the complexity involved in assessing whether an asset or a business has been acquired in a transaction.

The amendments come after the International Accounting Standards Board (IASB) completed its post-implementation review of the international standard, IFRS 3, in 2015. Stakeholders raised concerns about the broad definition of a ‘business’, which made it difficult to interpret and apply this definition in practice. The feedback called for guidance in assessing the relevance of any processes acquired, the significance of any missing processes, and how to apply the definition of a business when no revenue is being generated by an acquired entity.

In addition to addressing the above concepts, the revisions to IFRS 3 / AASB 3 include an optional ‘fair value concentration test’ that allows for a simplified assessment of whether an acquired set of activities and assets is not a business.

Distinction between ‘asset’ and ‘business’ is important

The accounting for business combinations under AASB 3 differs from the accounting for asset acquisitions (which fall outside the scope of AASB 3).

One of the key differences is that business combinations may give rise to goodwill while asset acquisitions do not. This is because with a business combination, assets and liabilities acquired are accounted for at their fair values on acquisition date. In contrast, an asset purchase is accounted for by allocating the transaction price to the individual assets and liabilities acquired based on their relative fair values on date of purchase.

Another key difference is that directly attributable transaction costs are expensed when accounting for a business combination, while such costs are capitalised as part of the cost of the asset in the case of an asset acquisition.

The differences in the treatment of a business combination and an asset acquisition will not only affect the acquisition date accounting but will also have an impact on future depreciation and possible impairment. Furthermore, disclosures are more arduous for business combinations.

Refined definition of ‘business’ and ‘outputs’

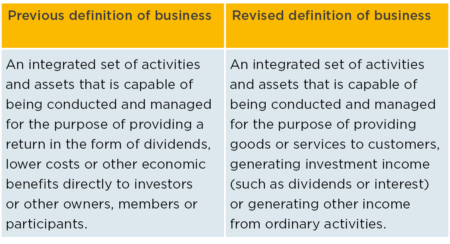

The table below shows how the definition of ‘business’ has been revised under the amendments to AASB 3:

As can be seen in the above definitions, the meaning of outputs has been narrowed to focus on goods or services provided to customers, investment income or other income from ordinary activities. The previous reference to ‘lower costs or other economic benefits’ was not overly helpful in distinguishing between an asset and a business as an acquired asset may also provide a return in the form of lower costs or other economic benefits. It was therefore removed from the definition of a business and the definition of outputs.

Minimum requirements for a business

The existence of a process (or processes) is what differentiates a business from a set of activities and assets that is not a business. Thus, to be considered a business, an acquired set of activities and assets must include, as a minimum, an input and a substantive process that together significantly contribute to the creation of outputs. This also makes it clearer that a business can exist without all the inputs and processes needed to create outputs being present, as long as the inputs and processes acquired can collectively significantly contribute to the generation of outputs.

The amendments to AASB 3 also recognise that, while most businesses do generate outputs, outputs are not a prerequisite for an integrated set of activities and assets to qualify as a business.

What is a ‘substantive’ process?

New guidance and illustrative examples have been added to AASB 3 to assist entities in assessing whether an acquired process is substantive. This guidance requires more persuasive evidence when there are no outputs because the existence of outputs already provides some evidence that the acquired set of activities and assets is a business. An example of an acquired set of activities and assets that does not have outputs is a new entity that has not yet generated revenue.

Where a set of activities and assets does not have outputs at the acquisition date, the acquired process is substantive only if:

- it is critical to the ability to develop or convert an acquired input into outputs; and

- the inputs acquired include both:

- an organised workforce that has the skills, knowledge, or experience to perform that process; and

- other inputs that the organised workforce could develop or convert into outputs, such as technology, in-process research and development projects, real estate interests and mineral interests.

The above guidance implies that an organised workforce is generally key to identifying a business. There is, however, a carve-out for situations where the acquired set of activities and assets does have outputs, and includes a process that is unique or scarce, or cannot be replaced without significant cost, effort or delay in producing outputs, as this would most likely indicate the acquired process is substantive despite the absence of an organised workforce.

An acquired contract is not itself a substantive process. However, an acquired contract, such as a contract for outsourced property management or outsourced asset management, may give access to an organised workforce and therefore a substantive process. This would be evaluated based on factors such as the contract’s duration and renewal terms.

Optional concentration test

Applying the definition of a business often involves significant judgement, and prior to the amendments discussed in this article, there was little or no guidance in AASB 3 that identified situations in which an acquired set of activities and assets is not a business. Accordingly, an optional fair value concentration has been introduced to AASB 3 which provides a simplified way of concluding that an acquisition is not a business combination. Entities can choose whether or not to apply this test on a transaction-by-transaction basis.

If the test is passed, it is concluded that the acquisition is not a business and no further assessment is required, regardless of any other factors or considerations. If the test is not met, or an entity decides not to perform the test, the usual assessment that determines whether or not a acquired set of activities and assets meets the definition of a business needs to be carried out. As such, the concentration test never determines that a transaction is a business combination.

AASB 3 explains that the optional concentration test is met if substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets. The test is based on gross, not net, assets as many businesses have liabilities but do not need them to be considered a business. Likewise, an acquired set that is not a business may have liabilities. In addition, certain assets are excluded from the gross assets considered in the test.

Assessing if substantially all the fair value is concentrated in a single identifiable asset, or group of similar identifiable assets, will require the use of judgement. Furthermore, there are specific rules that need to be applied when performing the concentration test. These are set out in AASB 3.B7B and are summarised as follows:

- Cash and cash equivalents, deferred tax assets and goodwill arising from the effects of deferred tax liabilities must be excluded from gross assets.

- A single identifiable asset must include any asset or group of assets that would be recognised and measured as a single identifiable asset in a business combination.

- A single identifiable asset includes assets that are attached or cannot be removed from other assets without incurring significant cost or loss of value of either asset (e.g. land and buildings).

- Assets are grouped (to form a group of similar identifiable assets) based on whether they are similar in nature and have similar risks associated with managing and creating outputs from the assets.

- Certain assets cannot be considered to be similar assets such as:

- a tangible asset and an intangible asset

- tangible assets in different classes

- intangible assets in different classes

- a financial asset and a non-financial asset

- financial assets in different classes

- identifiable assets within the same class of asset but that have significantly different risk characteristics.

Effective date of amendments

Important to note is that the revisions to AASB 3 are already effective. They apply to all business combinations and asset acquisitions with an acquisition date that is on or after the beginning of the first annual reporting period on or after 1 January 2020. Consequently, entities do not have to revisit these types of transactions that occurred in previous periods.

Example: Determining the fair value of the gross assets acquired

Fact pattern

Entity A holds a 40% interest in Entity X. Subsequently, on acquisition date, Entity A purchases a further 35% interest in Entity X, thereby obtaining control of Entity X. Entity X has the following assets and liabilities as at acquisition date:

- a building with a fair value of 500

- an identifiable intangible asset with a fair value of 50

- cash and cash equivalents with a fair value of 100

- deferred tax assets of 200

- financial liabilities with a fair value of 600

- deferred tax liabilities of 150 arising from temporary differences associated with the warehouse and the intangible asset.

Entity A pays 210 for the additional 35% interest in Entity X. The acquisition-date fair value of Entity X is determined to be 600, the fair value of the non-controlling interest (NCI) in Entity X is 150 (25% x 600) and the fair value of Entity A’s previously held interest in Entity X is 240 (40% x 600).

Analysis

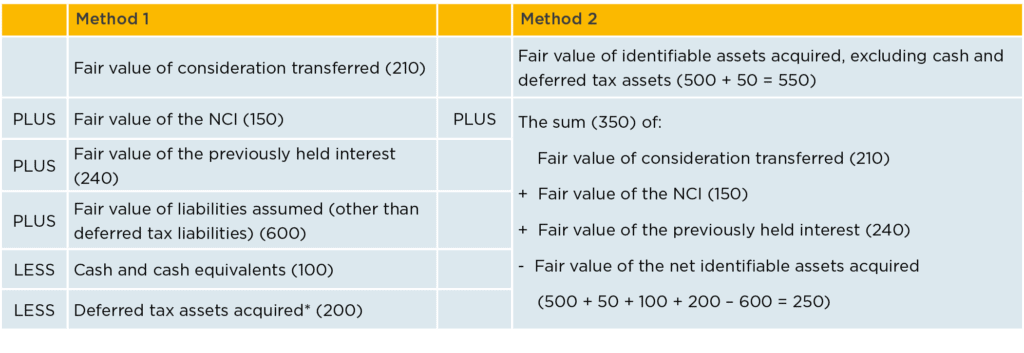

Should Entity A elect to perform the concentration test, it would need to determine the fair value of the gross assets acquired. This is determined to be 900, calculated using either of the following methods:

*In practice, deferred tax assets would only be excluded if including the deferred tax assets could lead to the concentration test not being met

The excess of the sum of the fair value of Entity X over the fair value of the net identifiable assets calculated in Method 2 above (i.e. 350) is determined in a manner similar to the initial measurement of goodwill in accordance with AASB 3. Including this amount in determining the fair value of the gross assets acquired means that the concentration test is based on an amount that is affected by the value of any substantive processes acquired.

Furthermore, the fair value of the gross assets acquired determined using Method 2 above (i.e. 550) excludes cash and cash equivalents (100) and deferred tax assets (200) as these items are independent of whether any substantive process was acquired. Also, the deferred tax liability is not deducted in determining the fair value of the net assets acquired (250) and does not need to be determined. As a result, the excess (350) calculated above does not include goodwill resulting from the effects of deferred tax liabilities.

Refer to the Illustrative Examples included as part of the amendments to AASB 3 for examples of when the concentration test could be met and how to apply the concepts clarified under the revisions to the standard.

This update was published in Issue 9 of the The Bottom Line.