The Resources sector, comprising of both materials and energy companies, contributed a substantial number of IPOs during 2021.

Overall, there were 112 new resources listings for the year raising a total of $2.27 billion in new capital. These listings were weighted towards the second half of the year with funds raised during this period totalling $1.62 billion. This was heavily influenced by the listing of 29Metals Limited (ASX: 29M) which raised $527.8 million.

Share price performance post-listing from resources companies was excellent with resource IPOs recording an average first day gain of 18% and an average gain by the end of the year of 24%.

On a state-by-state basis, the largest contributor was Western Australia with 84 new resource listings across the year raising a total of $936.53 million in the process. West Australian listings had strong gains of 22% from both a first day and year end perspective.

The strongest year end gains were recorded by Victoria (10 listings, 57% average year end gain) and South Australia (two listings with rare earth projects, 92% average year end gain). New South Wales also had a significant number of resource listings with 12 IPOs raising $574.61 million between them, but recorded an average first day loss of 6% holding to an average year end loss of 5%. The other traditional mining state of Queensland only had four listings.

Subscription rates were solid with 84% of the amounts sought being raised successfully across all listings.

The June and September quarters performed the best in terms of year end gains being 62% and 32% respectively. It was the March quarter that saw the worst year end share price performance against listing price with an average loss of 1%. The December quarter listings recorded a modest 3% average year end gain.

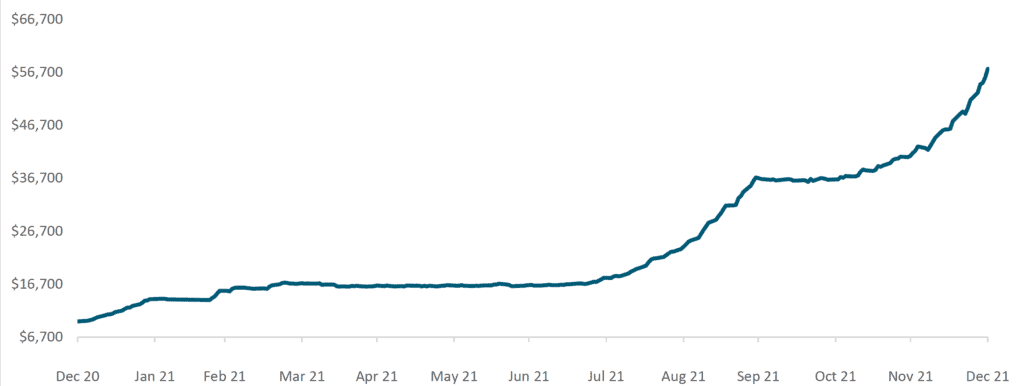

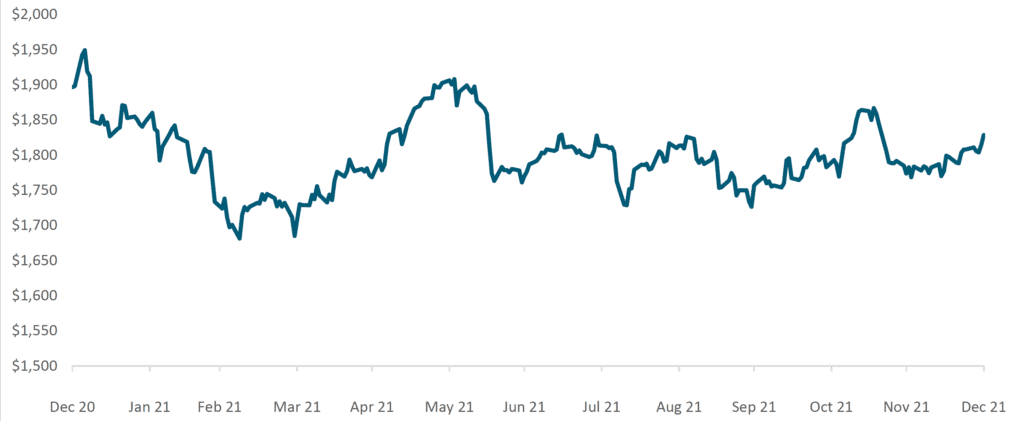

Resource IPOs were heavily weighted towards gold with 60 of the 112 listings having significant gold projects (including polymetallic explorers seeking multiple commodities). This aligns with gold commodity pricing which remains strong looking at a five-year average despite a slight decrease in the current year. Copper projects appeared in 31% of resource IPOs. Lithium stocks also had a strong showing with 10 listings having lithium projects. As an outstanding result, six of these lithium listings recorded average year end gains of over 100%, aligning with strong lithium commodity price growth in the second half of the year. The standout lithium performers were Global Lithium Resources Limited (ASX: GL1, year end gain 375%) and Lithium Energy Limited (ASX: LEL), year end gain 365%). Investors in these listings were justly rewarded and it demonstrates that there is money to be made in predicting the next ‘in demand’ commodity.

There are 17 listings in the pipeline so far for 2022 which is a significant proportion of the overall pipeline at the date of this report.

LITHIUM CARBONATE (T/$) – 2021 PRICE HISTORY

GOLD ($USD/OUNCE) – 2021 PRICE HISTORY

This article was published in the 2022 IPO Watch Australia Report.