To keep pace with international sustainability reporting developments, the Australian Government is in the process of legislating mandatory climate-related financial disclosures. Very large entities will be impacted first, as soon as 2024/2025, with the scope of the new climate reporting requirements extending to progressively smaller entities over a two-year period.

Since December 2022, Treasury has issued two consultation papers seeking feedback on key elements of its proposals to implement requirements for disclosure of climate-related financial risks and opportunities by entities in Australia. The proposals are based on the ISSB’s IFRS S2 Climate-related Disclosures (IFRS S2) that was issued in June 2023.

While IFRS S2, and IFRS S1 General Requirements for Disclosures of Sustainability-related Financial Information (IFRS S1), have an international effective date of 1 January 2024, local jurisdictions (such as Australia) need to decide whether, when and how to formally adopt and integrate these requirements into their reporting regimes. This is what the Australian Government is currently undertaking, applying a climate-first approach as allowed under the transition relief afforded under IFRS S1.

In this article we look at some of the key aspects of Treasury’s proposals.

Phased approach of reporting requirements

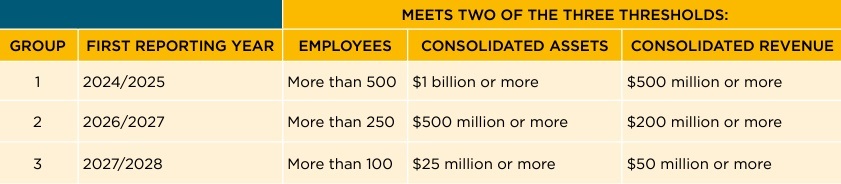

A three-phase approach will be used to implement mandatory reporting of climate-related financial disclosures, starting with the largest entities and then expanding to cover progressively smaller entities over a period of two years. This will allow entities on the smallest end of the spectrum to build capability in the lead up to the new reporting requirements becoming mandatory for them.

Entities reporting under Chapter 2M of the Corporations Act will be caught by the reforms where they meet two of the three thresholds, as indicated below:

As can be seen from the above table, from 2027/28, all entities that are ‘large’ under the Corporations Act will have to comply with the mandatory climate reporting requirements. Where an entity drops below the Group 3 threshold for a particular year, it would no longer be subject to these requirements. Such entities would need to consider continuing to report on a voluntary basis, especially where they anticipate being large again in the future.

Group 1 and Group 2 also include entities required to report under Chapter 2M that are ‘controlling corporations’ under the National Greenhouse and Energy Reporting Act (NGER) and meet the NGER publication threshold used by the Clean Energy Regulator (CER) to determine which emissions data to report publicly.

Group 3 extends to entities required to report under Chapter 2M and that are ‘controlling corporations’ under the NGER Act whether or not they meet the NGER publication threshold.

Charities that are registered with the Australian Charities and Not-for-Profits Commission (ACNC) are not captured by the proposals since these entities are not subject to Chapter 2M of the Corporations Act. However, not-for-profit entities that are not ACNC-registered and are required to report under Chapter 2M of the Corporations Act may be captured. This should be clarified when Government finalises its proposals.

Assurance requirements

The credibility of climate-related financial disclosures will be undermined in the absence of assurance over these disclosures. However, the Government acknowledges that significant capability uplift in terms of skills, capacity and processes is needed in the climate-related assurance space. It has therefore proposed scaling assurance requirements, starting with limited assurance in the first year of reporting and progressively moving to an end state of reasonable assurance over all climate disclosures by the fourth year of reporting.

Reporting

Materiality

Treasury’s proposed approach to materiality aligns with the ISSB’s position on materiality. That is, climate-related financial information is material if omitting, misstating or obscuring it could reasonably be expected to influence decisions that the primary users of general purpose financial reports (i.e., existing and potential investors, lenders and other creditors) make on the basis of those reports.

Location and timing

In line with current financial reporting practices in Australia, climate disclosures would be required to be published in an entity’s annual report. Entrenching climate disclosures in annual reporting processes will encourage Australian entities to integrate climate more deeply into their strategic decision making.

Climate disclosure requirements would be incorporated into Part 2M.3 of the Corporations Act and would be required as part of both the directors’ report and the financial report.

Listed entities would include their climate disclosures in the Operating and Financial Review (OFR) within the directors’ report.

In terms of timing of reporting, lodgement deadlines for annual financial reports (which includes climate disclosures) would remain the same as current requirements. That is, disclosing entities and registered managed investment schemes must lodge complete financial reports within three months after the end of financial year. All other companies are required to lodge their financial reports within four months after the end of the financial year.

For NGER entities, the statutory reporting deadline is 31 October for the preceding reporting year of 1 July to 30 June. To ensure consistency, entities should report the same emissions and energy data in their financial reports as they do in their NGER reporting.

Content

A key principle underlying the climate reporting reforms in Australia is close alignment with international reporting practices. Accordingly, Treasury’s proposals are based on the ISSB’s sustainability disclosure standards, with a climate-first approach being adopted.

The Australian Accounting Standards Board (AASB) has been charged with the responsibility to develop Australian climate disclosure standards, the content of which will be based on IFRS S2 and adapted for the Australian context.

Treasury’s proposals set out the disclosures expected to apply from commencement of the climate reporting regime. These relate to:

- Governance

- Qualitative scenario analysis (moving to quantitative scenario analysis by end state)

- Climate resilience assessments against two possible future states, one of which must be consistent with the global temperature goal set out in the Climate Change Act 2022

- Transition plans

- Climate-related targets and progress towards these targets

- Information about material climate-related risks and opportunities

- Scope 1 and Scope 2 emissions

In terms of Scope 3 emissions, it is proposed that these be disclosed by in-scope entities from their second year of reporting onwards. Scope 3 emissions disclosures made could be in relation to any one-year period that ended up to 12 months prior to the current reporting period.

Continuous disclosure and fundraising documents

Treasury’s consultation notes that climate-related disclosure obligations would extend to continuous disclosure and fundraising document obligations, and no modifications to or exclusions from those obligations are proposed. ASIC has previously noted that, depending on the circumstances, climate-related risk disclosure may already be required by law, for example within a prospectus or continuous disclosure announcement.

Liability and enforcement

Under the proposals, the Government intends to introduce civil penalty provisions into the Corporations Act so that a failure to disclose, or inadequate disclosure, would attract a civil penalty. Furthermore, ASIC will be able to issue infringement notices for non-compliance with the new requirements, which will operate alongside existing legal frameworks including directors’ duties, misleading conduct and representation provisions, as well as current reporting requirements.

To balance the importance of disclosing decision-useful information with appropriate protections for reporting entities, it is proposed that for the first three years of the climate reporting regime (i.e., from 1 July 2024 to 30 June 2027), elements of mandatory disclosure including Scope 3 emissions, scenario analysis and transition planning would be shielded from misleading and deceptive conduct, false or misleading representations, and similar claims brought by private litigants. Regulators (such as ASIC) could still take action during the fixed three-year period, where appropriate.

Next steps

Treasury is currently considering feedback it received on its latest consultation that closed in July 2023. Where legislation is required to give effect to the new requirements, such draft legislation will be exposed before being implemented in line with the initial commencement date of 1 July 2024.

In terms of standard-setting, and to support Treasury’s proposals discussed in this article, the AASB has recently released an Exposure Draft, ED SR1 Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information. The proposals in the ED are based on the ISSB’s IFRS S1 and IFRS S2, setting out the climate-related disclosures in-scope entities would be required to make. The Exposure Draft is open for comment until 1 March 2024.