Overview

As part of the Federal Government’s COVID-19 related economic recovery and tax incentives, the Government introduced a corporate loss carry back tax offset into the Income Tax Assessment Act 1997.

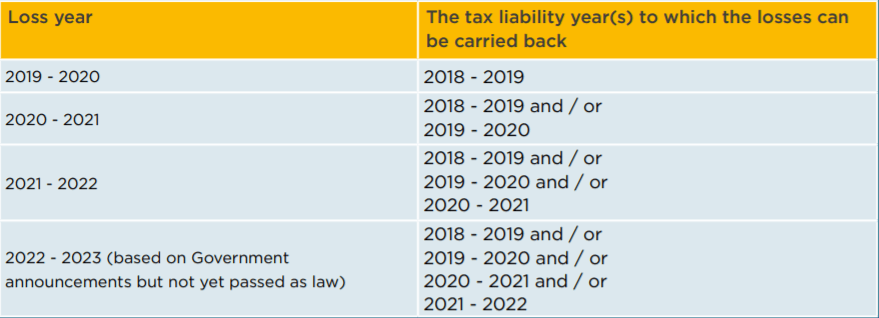

The loss carry back tax offset essentially allows eligible corporate entities (companies, corporate limited partnerships and public trading trusts) to ‘carry back’ tax losses in their 2021 and 2022 (and 2023 based on recent Government announcements but not yet passed as law) tax returns to offset profits and tax paid as far back as the 2019 tax year. This provides a mechanism to apply for a refund for tax paid in prior years as a tax offset if there is a tax loss in more recent years (i.e. FY 2020, 2021, 2022 and 2023).

The loss carry back measure rules apply to corporate tax entities that have aggregated turnover of less than $5 billion in the relevant loss year, noting the aggregated turnover test is referenced to small business entity concessions rules.

Eligible losses

Under the loss carry back measure, an eligible corporate entity is able to choose to carry back income tax losses, but not capital losses, to prior years. Therefore other losses that cannot be carried back, for example, are:

- Losses that have been transferred by a joining entity to the head company of a consolidated group (i.e. Div 707 losses).

- Losses which arose as a result of excess franking offsets (i.e. franking offsets converted to losses).

In addition, it is also a requirement that the company has satisfied its lodgement requirements, or assessments have been made by the Commissioner for the current year and each of the five income years before the current year (unless they are not required to lodge an income tax return).

How to calculate the loss carry back

There is essentially a 3-step process to calculate a loss carry back tax offset for the current year:

- Make a ‘loss carry back choice’ for the current year. This includes, for example, to choose to carry back a tax loss from one loss year to one or two tax liability years; or to choose to carry back tax losses from two loss years to one tax liability year. The choice can be made when preparing the company’s tax return;

- Calculate the loss carry back tax offset components for each tax liability year(s); and

- Calculate the loss carry back tax offset for the current year, subject to tax liability and franking account balance limitations (discussed below).

1. Loss carry back choice

To carry back a loss, the company must make a ‘loss carry back choice’ for the current year. The choice must be made in the approved form which will usually be the company tax return.

2. Loss carry back tax offset component for each tax liability year

The company’s loss carry back tax offset component for an income year can be calculated using the three steps below:

- Choose the tax loss in particular loss year(s) to be carried back to particular tax liability year(s);

- Reduce step 1 amount by the company’s net exempt income for the year (if any); and

- Multiply the step 2 amount by the corporate tax rate for the loss year (noting the corporate tax rate for the loss year may be different from the tax liability year).

The company’s loss carry back tax offset component for the income year should not exceed the step 3 amount. Where tax losses are carried back to more than one tax liability year, the above steps should be undertaken for each relevant tax liability year (refer to Example 2 below).

3. Loss carry back tax offset for current year

The current year loss carry back tax offset equals the sum of the loss carry back tax offset components, subject to the franking account balance of the company at the end of the year in which the company seeks to claim the loss carry back offsets.

Limitations to the offset amount

Income tax liability

The amount of the carried back tax offset to an income year is limited to the income tax liability for that specific income year.

Franking account balance

The loss carry back tax offset for an income year is limited to the company’s franking account balance at the end of the year in which the company seeks to claim the carry back offsets. If the offsets exceed the franking account balance, the loss carry back tax offset amount is reduced to the franking account balance of that year.

Integrity rules

The loss carry back offset measure is subject to a set of integrity rules and companies will need to selfassess the application of these integrity rules. Very broadly, a company cannot carry back a tax loss to an income year if there is a scheme for a disposition of membership interests, or an interest in membership interests, where the disposition results in a change in who controls, or is able to control (whether directly or indirectly), the voting power of the company.

Where the specific loss carry back offset integrity rule does not apply, the general anti-avoidance rules can apply to schemes entered into with the purpose of obtaining the tax benefit.

From an accounting perspective

AASB 112 Income Taxes permits entities to recognise deferred tax assets to the extent that it is probable that future tax profits will be available against which those tax losses can be utilised.

An entity that was making tax profits pre-COVID-19 will probably have recognised a deferred tax asset for any loss incurred in 2020 as a result of the pandemic on the basis that the entity will return to profitability in the near future, either once the entity has adjusted to the ‘new normal’ or once the pandemic has run its course.

If, in 2021, an entity is eligible to apply the loss carry back provisions discussed above and elects to do so, any deferred tax asset recognised in 2020 for COVID-19 tax losses would need to be adjusted in the current year to reflect that those losses will no longer be used to reduce future tax profits but will instead be received as a refund. That is, the deferred tax asset would be reduced and an income tax receivable recognised for the refund.

Practical examples

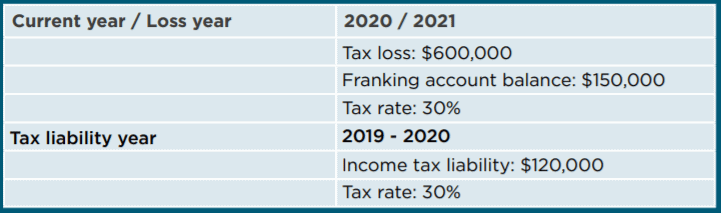

Example 1 – Tax loss from one loss year carried back to one tax liability year

Loss carry back tax offset for the 2020 / 2021 year is calculated as follows:

Offset component for the 2019 / 2020 year: $600,000 x 30% = $180,000.

As the franking account balance at the end of the loss year ($150,000) as well as the income tax liability of the tax liability year ($120,000) are less than the calculated offset component of $180,000, the total loss carry back for the 2020 / 2021 income year is limited to $120,000.

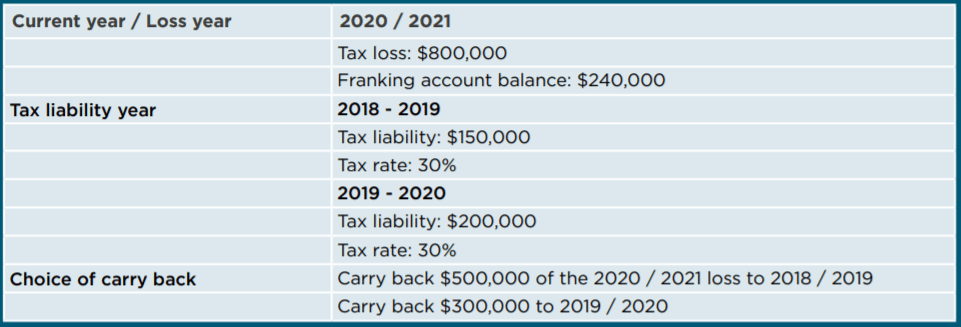

Example 2 – Tax loss from one loss year carried back to two tax liability years

Loss carry back tax offset for the 2020 / 2021 year are calculated as follows:

- Offset component for the 2018 / 2019 year: $500,000 x 30% = $150,000 (which is equal to that year’s tax liability); and

- Offset component for the 2019 / 2020 year: $300,000 x 30% = $90,000 (which is less than that year’s tax liability).

The sum 1 and 2 above is $240,000.

As the sum of the loss carry back tax offset components is equal to the franking account balance at the end of the current year, the offsets will not be reduced / limited. Therefore, the total loss carry back tax offset for the 2020 / 2021 income year is $240,000.

This article was authored by Gloria Liang, Tax Manager at HLB Mann Judd Melbourne. It was first published in The Bottom Line Issue 10.