Since the formation of the International Sustainability Standards Board (ISSB) in late 2021, things have moved at an unprecedented pace. The ISSB has since developed, exposed and issued its first two sustainability-related disclosure standards, marking a significant step towards elevating the prominence of sustainability reporting to match that of financial reporting.

The ISSB

In response to a global push for more consistent, comparable and verifiable sustainability-related information, the ISSB was established by the IFRS Foundation in November 2021.

To leverage off existing (and non-mandatory) sustainability reporting frameworks, standards and materials, the formation of the ISSB saw the consolidation of the Climate Disclosure Standards Board (CDSB) as well as the Value Reporting Foundation which governed materials from the Sustainability Accounting Standards Board (SASB) and the International Integrated Reporting Council (IIRC). Furthermore, the ISSB sought to build on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

Like the International Accounting Standards Board (IASB), the ISSB is overseen by the IFRS Foundation making them ‘sibling’ standard-setters. This will allow close cooperation between the two bodies, ensuring connections between IFRS accounting standards (IASB) and IFRS sustainability disclosure standards (ISSB).

The objective of the ISSB is to establish a global baseline of sustainability-related financial disclosures to meet the needs of investors. This will simplify the sustainability reporting landscape by removing the need to consider and choose from several voluntary sustainability reporting frameworks that currently exist.

While the ISSB is responsible for developing IFRS sustainability disclosure standards at the international level, it will be up to local jurisdictions to decide whether, when and how to incorporate these standards into their local reporting regimes.

IFRS sustainability disclosure standards

The ambition of the ISSB is to develop a complete suite of standards that will facilitate the disclosure of information about the financial impact of sustainability-related risks and opportunities on entities so that investors can make better-informed decisions.

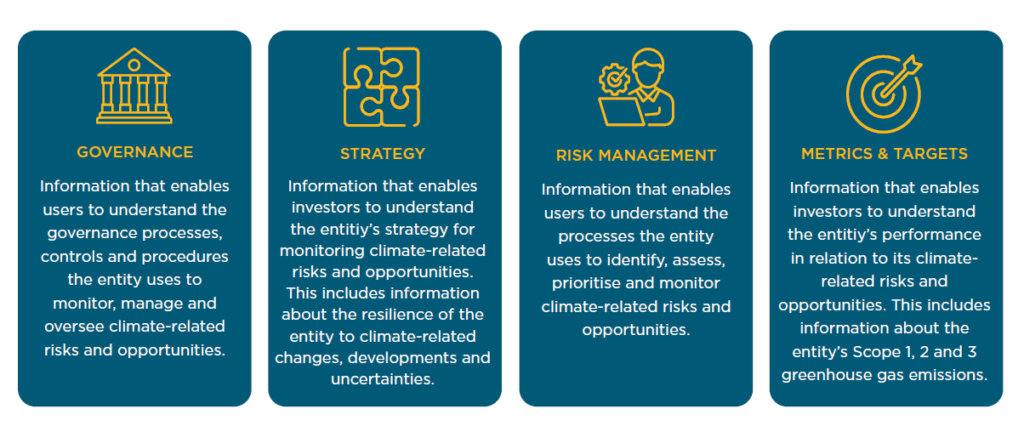

The construct of the standards is based on the internationally recognised TCFD framework which consists of four pillars, namely governance, strategy, risk management, and metrics and targets.

Key features of the ISSB’s sustainability disclosure standards to be aware of:

- Time of reporting – Reporting under IFRS sustainability disclosure standards will occur at the same time, and for the same period, as the financial statements.

- Reporting entity – Sustainability-related financial disclosures are provided for the same reporting entity as the financial statements. This means that each element of an entity’s general purpose financial report (which includes both the financial statements and sustainability-related financial disclosures) provides information about the same consolidated group or reporting entity.

- Location of disclosures – Sustainability-related information must be provided alongside financial statements, as part of the same reporting package. However, it will be up to local jurisdictions to decide on the exact location of this information within general purpose financial reports.

- Connected information – Information provided should allow users to assess the connections between various sustainability-related risks and opportunities, and to assess how information about these are linked to the related financial statements.

- Materiality – Similar to the concept of materiality applied in applying accounting standards, sustainability-related information is material if omitting, misstating or obscuring that information could reasonably be expected to influence decisions made by investors.

- Forward-looking information – Disclosures need to provide forward-looking insight about the impact of sustainability-related risks and opportunities on the company’s strategy, business model and financial statements over the short, medium and long-term.

- Value chain – An entity is required to disclose material information about sustainability-related risks and opportunities throughout its value chain. The value chain is the full range of interactions, resources and relationships related to the entity’s business model and the external environment in which it operates.

Furthermore, data and assumptions used in preparing sustainability-related financial disclosures must be consistent—to the extent possible—with the corresponding data and assumptions used in preparing the related financial statements.

Already, the ISSB has issued its first two sustainability disclosure standards, being:

- IFRS S1 General Requirements for Disclosures of Sustainability-related Financial Information (IFRS S1); and

- IFRS S2 Climate-related Disclosures (IFRS S2).

IFRS S1

IFRS S1 can be viewed as a base standard, setting the foundation for how entities should disclose sustainability-related financial information as well as the requirements for providing a complete set of such disclosures.

Many of the concepts that underpin IFRS S1 are rooted in the IASB’s Conceptual Framework as well as certain IFRS accounting standards such as IAS 1 Presentation of Financial Statements and IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. Preparers of financial statements should therefore be familiar with many of the concepts and general requirements found in IFRS S1.

IFRS S1 requires entities to disclose material information about all sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s prospects. The key takeaway here is that the standard does not require disclosure of every sustainability-related risk and opportunity, only those that could reasonably be expected to affect the entity’s cash flows, access to finance or cost of capital over the short, medium or long term. The focus is on investors and disclosure of sustainability-related information that could influence the decisions they make about allocating resources to the entity.

As a high-level summary, IFRS S1:

- Is ‘GAAP agnostic’ meaning entities can apply IFRS S1 (and other ISSB standards) whether their financial statements are prepared in accordance with IFRS accounting standards or other generally accepted accounting principles (GAAP)

- Is designed to be applied in conjunction with sustainability disclosure standards that address a specific sustainability topic (such as IFRS S2 that deals with climate-related disclosures)

- Requires disclosure of material information about sustainability-related risks and opportunities across an entity’s value chain to meet the needs of investors

- Explains the general features that underpin useful sustainability-related disclosures

- Requires disclosure of sustainability-related information that cuts across the areas of governance, strategy, risk management, and metrics and targets (consistent with the TCFD framework)

- Specifies sources of guidance that entities must or can refer to when identifying their sustainability-related risks and opportunities and the appropriate information to disclose about them

- Requires disclosure of information related to significant judgements and uncertainties underlying sustainability disclosures, and explains the required treatment of previously reported errors

- Requires disclosures that allow investors to understand the connections between and within the various sustainability-related risks and opportunities, as well as the connections between sustainability-related financial disclosures and the related financial statements.

IFRS S2

IFRS S2 focuses on climate-related disclosures. As alluded to above, it must be applied together with IFRS S1.

The standard requires entities to disclose material information about their climate-related risks (both physical and transitional) and opportunities that are decision-useful for users of their general purpose financial reports.

IFRS S2 establishes a structure for entities to provide climate-related information across the TCFD’s four core content areas as follows:

Within IFRS S2, under each of the headings above, there are a number of prescribed disclosures, including (but not limited to):

- Information about, including the identity of, the body or individual(s) charged with oversight of climate-related risks and opportunities

- The current and anticipated effects of identified climate-related risks and opportunities on the entity’s business model and value chain

- The effects of climate-related risks and opportunities on the entity’s strategy and decision-making, including information about its climate-related transition plan

- The resilience of the entity’s strategy and its business model to significant physical and transition risks. This includes how climate-related scenario analysis is used to inform climate resilience

- Information about climate-related metrics (including Scope 1, Scope 2 and Scope 3 greenhouse gas emissions) used to mitigate and adapt to climate-related risks, or maximise climate-related opportunities

- Information about climate-related targets to monitor progress towards achieving the entity’s strategic goals

- Whether carbon off-sets will be used to achieve climate-related targets

Effective date

Both IFRS S1 and IFRS S2 are effective for annual reporting periods beginning on or after 1 January 2024, however, it will be up to local jurisdictions to determine whether, how and when to integrate these standards (and future sustainability disclosure standards) into their local reporting requirements. Entities can choose to apply the standards voluntarily.

First year transition reliefs

There are various reliefs available to entities in the first year of applying IFRS S1 and IFRS S2.

Climate-first approach

The most significant relief allows entities to adopt a climate-first approach. This means information about sustainability-related risks and opportunities other than those related to climate is not required in the first reporting period. Entities that make use of this relief will need to disclose this fact.

Comparative information

Entities are not required to disclose comparative information in the first annual reporting period in which IFRS S1 and IFRS S2 are applied.

Timing of reporting

Under this relief, entities are permitted to report their sustainability-related financial disclosures after they publish their related financial statements.

For interim reporters, their first sustainability-related financial disclosures will be provided at the same time as the next second-quarter or half-year financial reports.

Where entities do not report at interim, their first annual sustainability-related financial disclosures must be reported within nine months after the end of the reporting period.

Greenhouse gas emissions

Disclosures of Scope 3 emissions are not required for the first annual reporting period in which an entity applies IFRS S2.

Furthermore, entities are permitted to continue to use their existing methodologies to measure their Scope 1, Scope 2 and Scope 3 greenhouse gas emissions instead of the GHG Protocol Corporate Standard for the first annual reporting period in which IFRS S2 is applied.

If an entity takes advantage of either of these reliefs, the entity is permitted to continue using that relief for the purposes of presenting that information as comparative information in subsequent reporting periods.

This article was first published in The Bottom Line – Issue 17.