With the Australian Government legislating mandatory climate-related financial disclosures it will bring with it a requirement for certain entities to disclose their Greenhouse Gas (GHG) emissions. Many organisations will need to upskill their boards, management and employees to understand these new concepts. This article outlines what is involved with calculating GHG emissions.

IFRS S2 Climate-related Disclosures requires entities to disclose GHG emissions consistent with methodologies in the GHG Protocol Standards, unless an organisation is required to report under any other jurisdictional authority or exchange. It is likely that the Australian-equivalent of IFRS S2, namely ASRS 2 Climate-related Financial Disclosures which is currently being finalised, will require the same.

The GHG Protocol Standards are a global framework developed to measure and manage GHG emissions. The relevant standards to be applied are:

- Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard

- Greenhouse Gas Protocol: Corporate Value Chain (Scope 3) Accounting and Reporting Standard

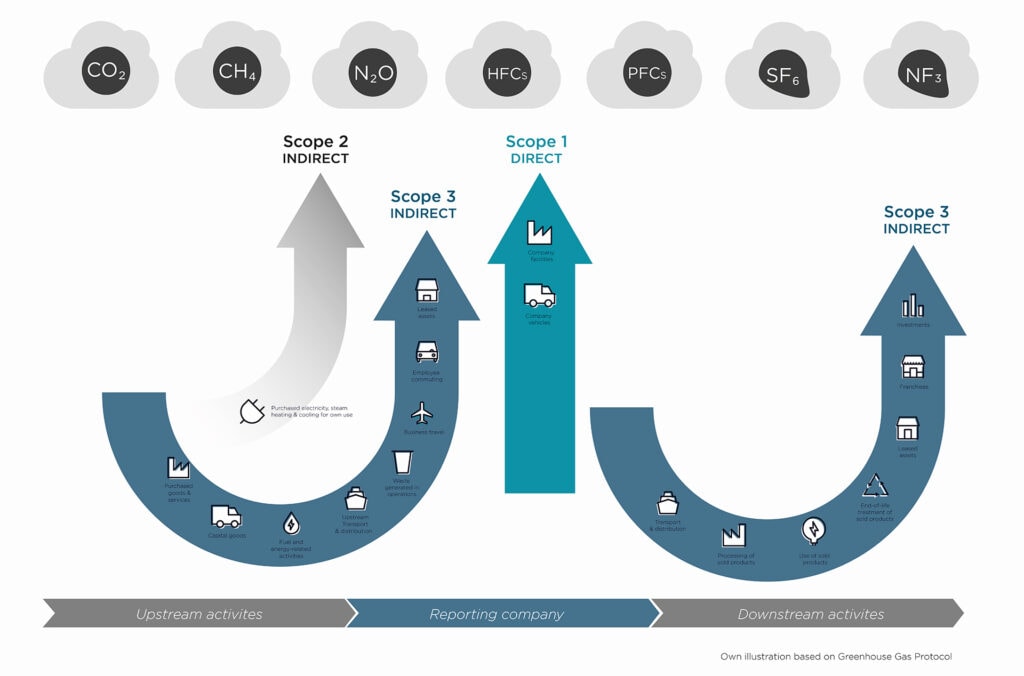

The GHG Protocol covers the accounting and reporting of seven GHGs – carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O) hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulphur hexafluoride (SF6) and nitrogen trifluoride (NF3). The seven GHGs are converted and reported as the global warming potential of one unit of CO2.

The importance of carbon accounting

Accounting for your GHG emissions goes beyond just meeting disclosure requirements. Measuring the sources of your emissions enables your organisation to manage GHG risks and identify reduction opportunities.

It provides a competitive advantage particularly for businesses that have reporting entities as their customers. Your organisation’s Scope 1 and Scope 2 emissions are your customers’ Scope 3 emissions. Providing GHG emission information to customers assists them to calculate and disclose their GHG emissions and determine reduction opportunities more accurately. And it may be that customers start to demand this information, without which the continuation of the relationship could be compromised.

The process

Boundary setting

Setting organisational boundaries

The first step is to determine which businesses and operations need to be included in your GHG emissions reporting. The GHG protocol sets out two approaches – the equity share approach and control approach. Entities can choose the most appropriate approach for their operations.

Equity share approach is where GHG emissions are accounted for according to the share of equity in an operation.

Control approach requires 100% of GHG emissions to be reported from operations controlled by the organisation. Control is defined as either financial or operational.

- Financial control means having the ability to direct the financial and operating policies of a business or operation. This includes having the right to the majority of the benefits and retaining the majority of the risks.

- Operational control involves having full authority to introduce and implement operating policies within a business or operation.

Setting operational boundaries

The operational boundary defines the relevant scopes to be reported based on the determined organisational boundary and business goals of the organisation.

Australian entities captured by the new climate reporting regime will be required to disclose their gross GHG emissions generated in the reporting period, measured separately as Scope 1, Scope 2 and Scope 3 emissions.

Scope 1: Direct GHG emissions

Direct GHG emissions are from sources owned or controlled by the organisation and include four categories.

- Generation of electricity, heat or steam – combustion of fuels in stationery sources such as boilers and furnaces.

- Physical or chemical processing – from the manufacture and processing of chemicals and materials such as cement and aluminium.

- Transportation of materials, products, waste and employees – combustion of fuels in company owned or controlled vehicles including cars, trucks and airplanes.

- Fugitive emissions – from the release of gases such as hydrofluorocarbon (HFC) emissions from refrigeration and air conditioning equipment.

Scope 2: Electricity indirect GHG emissions

These encompass GHG emissions from the generation of purchased electricity that is consumed in the organisation and can be reported as location-based or market-based.

- Location-based is calculated as the average of the emissions intensity of electricity generation assets inside a specific geographical boundary.

- Market-based is calculated as the actual emission intensity from a direct arrangement with an electricity provider e.g. purchasing power agreement (PPA).

Under IFRS S2, location-based Scope 2 emissions are required to be disclosed, while organisations can choose to disclose market-based emissions if considered useful to users. Again, ASRS 2 is likely to align with these international requirements once finalised.

Scope 3: Other indirect GHG emissions

These are other GHG emissions that occur in the value chain of the organisation both upstream and downstream, from sources not owned or controlled by the company. There are 15 Scope 3 categories included in the GHG Protocol.

Upstream emissions are indirect emissions related to purchased goods and services including material acquisition and pre-processing. There are eight upstream categories being:

- Purchased goods and services – emissions from purchased goods and services not included in other upstream Scope 3 categories.

- Capital goods – emissions from purchased capital goods such as equipment, buildings and vehicles.

- Fuel and energy related activities – not included in Scope 1 and Scope 2.

- Upstream transportation and distribution – transport and distribution of products purchased in vehicles not owned by the reporting entity, purchased inbound and outbound logistics.

- Waste generated in operations – emissions from disposal and treatment of waste generated.

- Business travel – emissions from business travel including air, rail, bus, rental cars and employee-owned cars excluding commuting to work.

- Employee commuting – emissions from employees commuting by car, bus, rail, air and other transportation.

- Upstream leased assets – operation of assets leased by the entity.

Downstream emissions are indirect emissions relating to sold goods and services, which includes emissions from distribution and storage, use of products and end of life. There are seven downstream categories:

- Downstream transportation and distribution – transportation of products sold between the entity’s operations and end consumers.

- Processing of sold products – processing of intermediate products sold.

- Use of sold products – the direct use emissions of sold products over the expected product lifetime.

- End of life treatment of sold products – waste disposal and treatment of products at end of life.

- Downstream leased assets – operation of assets owned by the reporting entity and leased to other entities.

- Franchises – emissions from the operation of franchises not included in Scope 1 and Scope 2.

- Investments – primarily for financial institutions.

Measurement

The final step is to collect data and calculate Scope 1, Scope 2 and the relevant Scope 3 emissions to be disclosed for your organisation. This can be calculated in-house using carbon accounting software or outsourced to a specialised carbon accounting expert. We will explore data collection and calculation in future articles.

This article was authored by Rebecca Zuromski, Associate Director, ESG Advisory Adelaide.