On 5 April 2019 the ATO issued a final tax ruling TR 2019/1 in which it confirmed the views expressed in the draft 2017 version of the ruling that for certain purposes the scope of “carrying on a business” will extend to a company that holds primarily passive assets such as property, shares or other financial investments as long as its activities are carried out with a view to making a profit, including simply holding the assets to derive an income stream and for future capital gains.

Importantly, the position that the ATO has taken in this ruling opens these investment companies up to a wider range of tax concessions than previously thought. While the ATO is still in the process of updating the guidance on their website, we have been able to obtain informal comments from the ATO on each of the points discussed below.

Scope of TR 2019/1

There are two situations covered by this ruling:

- Applying the lower company tax rate of 27.5% to a “small business entity” (SBE) for the 2016 and 2017 tax years, which affected both the tax paid by the company and the rate at which dividends paid were to be franked; and

- Determining whether a company would meet the definition of SBE under Division 328 of the tax legislation, which as discussed below is relevant to claiming a range of small business tax concessions not only in the 2016 and 2017 years but also in subsequent years, and is the main focus of this article.

Tax concessions available to SBEs

While there are other tax concessions that can be available to small businesses more broadly, there are four common concessions that as a result of this tax ruling should now be available not only to active trading businesses, but also to passive investment companies.

Three of these concessions should be available indefinitely to any investment company that qualifies as a SBE because its annual turnover (when aggregated with related entities) does not exceed $10m.

- An immediate deduction for prepaid expenses

This applies where the period to which the expense relates is no more than 12 months. By contrast, for larger companies, prepaid expenses must generally be apportioned over the relevant period. For example, an investment company might choose on 30 June 2019 to prepay the fees owing to an external investment manager for the next 12 months, and as a result of this ruling the payment would now be deductible in full in the 2019 financial year.

- An immediate deduction for entity start-up costs

This covers capital costs traditionally referred to as “black-hole” expenses, including advisors’ fees and ASIC fees relating to incorporating a company or establishing the structure more generally. These costs would not normally be tax-deductible, nor would they be included in the cost base of any asset for capital gains tax (CGT) purposes.

While trading businesses that are not SBE’s can claim these costs over a 5 year period under section 40-880 of the tax legislation, an SBE is able to claim an immediate tax deduction in the year that the cost is incurred. By bringing investment companies into the definition of carrying on a business, the tax ruling will also allow them to claim a deduction for start-up costs, something that we would not previously have thought was possible.

- Instant asset write-off – SBE’s (turnover not exceeding $10m)

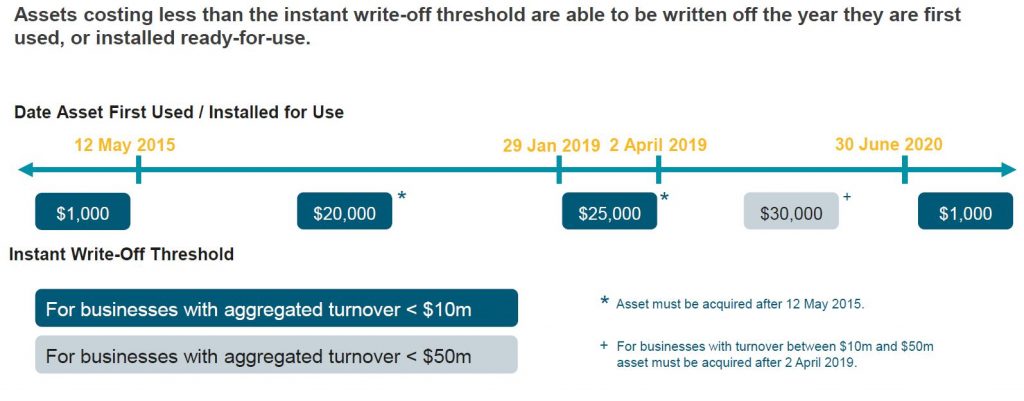

As illustrated in the diagram below, SBE’s are able to claim an instant write-off for any fixed assets such as plant and equipment costing less than $20,000 that were acquired between 12 May 2015 and 28 January 2019, less than $25,000 for acquisitions between 29 January 2019 and 7.30pm on 2 April 2019, and less than $30,000 for acquisitions between that time and 30 June 2020, after which the write-off threshold is due to revert to $1,000.

It is clear that, because an investment company is treated as carrying on a business for this purpose under TR 2019/1, where its aggregated turnover does not exceed $10m it would qualify as a SBE, and for the instant asset write-off. While most investment companies of this scale will probably have little in the way of fixed asset acquisitions, it is still an example of a tax concession that we would not have thought was relevant until the ATO released their ruling.

The fourth concession will be available only up until 30 June 2020, as detailed below.

- Instant asset write-off – Medium Businesses (turnover between $10m and $50m)

This measure was announced in the April 2019 Federal Budget and has already been passed into law. As shown on the diagram below, the instant asset write-off for assets costing less than $30,000 acquired between 7.30pm on 2 April 2019 and 30 June 2020 has been extended to “Medium Business” entities with turnover between $10m and $50m.

While it was not immediately clear whether the expanded definition of “carrying on a business” under TR 2019/1 would apply to investment companies, we have received informal confirmation from the ATO that this will be the case because the amendment introducing the concession for Medium Businesses allows the instant asset write-off on the assumption that the turnover threshold had been increased to $50m, i.e. it effectively treats the company as if it was a SBE when determining whether the Medium Business concession is available.

Other small business tax concessions not available to investment entities

Finally, it is also worth highlighting that some of other small business tax concessions such as the reduced company tax rate of 27.5% and the small business CGT concessions remain unavailable to passive investment companies, but apply only to active trading businesses.