The days of businesses operating without detailed consideration of the greenhouse gas emissions and sustainability impacts are quickly expiring.

Consistent with many global economies, the Australian government is taking an active approach to addressing global climate change. In 2022, the government committed to reduce greenhouse gas emissions across the Australian economy to 43 per cent below 2005 levels by 2030. Australia’s whole-of-economy long-term emissions reduction plan is to achieve net zero emissions by 2050.

This has and will drive significant investment and change throughout our economy and presents significant opportunities for all businesses, no matter their size or industry.

In support of these initiatives, the Australian Treasury released a proposal in June 2023 for implementing mandatory climate-related reporting disclosures. The current proposal would require certain entities (subject to size thresholds) to provide climate-related disclosures from as early as 1 July 2024.

The Australian reporting standards for climate-related disclosures will be substantially aligned to the climate management standards set by the International Sustainability Standards Board (ISSB).

The ISSB sustainability disclosure standards incorporate some of the established sustainability measurement and reporting guidance in the market, including the Taskforce on Climate-Related Financial Disclosures (TCFD).

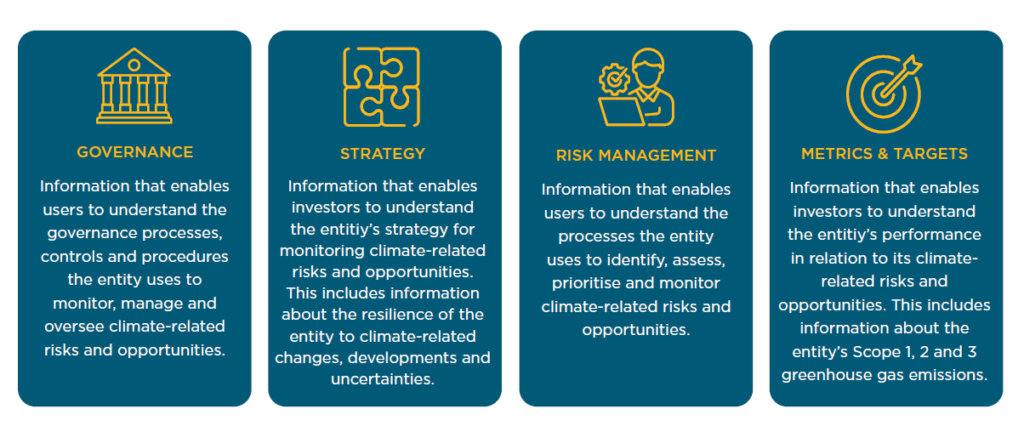

Reporting entities will be obliged to delve into the TCFD’s four pillars:

What the ‘Scopes’ mean for businesses

Scope 1, Scope 2 and Scope 3 – 3 greenhouse gas emissions, describe the sources of emissions expressed in kilotonnes of carbon dioxide equivalence.

- Scope 1 emissions are the emissions an entity directly controls and owns, such as those produced by their business-owned vehicles.

- Scope 2 emissions are the indirect emissions linked to purchased or acquired energy, electricity, heating or cooling consumed by the entity itself.

- Scope 3 emissions are the broadest class and stem from activities not controlled or owned by the entity but are a result of the entity’s value chain, including upstream and downstream emissions.

When an entity reports on Scope 3, it opens a vast array of emissions data from upstream and downstream partners in its value chain. This means supplier or customer activities might find their way into another organisation’s emission calculations.

In response, reporting entities will likely show a preference for suppliers who not only measure their emissions but can also prove they’re cutting down their emission intensity. This has and will drive real changes in customer/supplier relationships.

Impact on SMEs

While the mandatory reporting requirements will initially impact on the largest entities in the economy, there will be rapid flow on impacts to every organisation.

Small and medium-sized enterprises (SMEs) will undergo a major transformation due to mounting pressure from supply chain partners and customers who are directly impacted by stakeholder requirements to capture and measure the greenhouse gas emissions within their enterprise activities.

As the pressure mounts on reporting entities to reduce their carbon footprint, a greater number of SMEs will find themselves on the path to decarbonisation or risk being shut out from valuable customer opportunities. As such, now is the time for SMEs to consider their impact on supply chain greenhouse emissions and calculate their carbon footprint – a vital first step on the journey towards decarbonisation.

While emissions measurement and reporting requirements may seem onerous, there are rapidly developing solutions available to assist SMEs. If not prepared, businesses could potentially run the risk of losing existing clients or being excluded from new client tender opportunities if they cannot provide relevant emission related information when required.

The opportunities for SMEs

Being aware of the sustainability impacts of your the business will add value, to the business and potentially provide a competitive advantage.

There are many ways SMEs can harness benefits from investing in ESG and sustainability. Businesses can differentiate their market position if they are progressive in adopting an emission reduction target, which may add value to their proposition within the supply chains of larger businesses.

As companies develop a robust, sustainability reporting ecosystem, they can monitor their progress as they roll out a strong ESG strategy. This should help them to drive value and crucially, make them attractive to customers, suppliers, employees and financial providers.

Personal risks for directors

While it’s important and valuable for entities to establish an emissions related strategy, directors must be conscious that many aspects of climate-related disclosures are inherently forward-looking. Under the Corporations Act, forward-looking statements made without reasonable grounds may be taken to be misleading.

ASIC has provided guidance that it is actively alert to the risk of ‘greenwashing’ claims made by organisations. To minimise risk, directors need to actively ensure the content of climate-related disclosures are based on high quality information and can be substantiated.

As businesses we progress towards mandatory climate-related disclosures, HLB Mann Judd is are ready to assist business owners and managers commence their emissions measurement and reporting strategy journey.

This article was first published in The Bottom Line – Issue 17.