As parents, we all want our grown-up children to do well in life and achieve their goals, whether that’s climbing the career ladder, starting their own business or buying their first home.

Sadly, there are many obstacles standing in the path to homeownership for young Australians these days – the biggest of which is housing affordability, despite current market conditions.

Property prices might be falling, but so high was the recent peak, they would have to fall again by more than 20% to wipe out the gains they saw over the boom, according to recent Domain calculations.

So, the downturn hasn’t really chipped away at the size of the deposit your child needs to get on the property ladder.

Take Sydney, which had a median house value of $1.257m in October 2022, according to CoreLogic. That means your child needs to find more than $250,000 for a 20% deposit.

On top of that, they’ll also have to save for the associated purchase costs, such as stamp duty, conveyancing fees, home loan application fees and property inspections.

Of these upfront costs, the biggest is stamp duty.

It’s great news that first home buyers in NSW are being given the choice between a large upfront stamp duty fee or a much smaller ongoing annual property tax, for properties worth up to $1.5 million, after landmark legislation passed the state parliament in November 2022.

This is known as the First Home Buyer Choice (FHBC).

When does FHBC begin?

FHBC came into effect on 16 January 2023. However, any eligible first home buyers who purchase a property from 12 November 2022 until 15 January 2023 can get a refund on their stamp duty if they choose to opt into the tax by 30 June 2023.

How does the FHBC work?

FHBC lets first home buyers opt out of paying stamp duty upfront in exchange for a smaller annual tax of:

- $400 plus 0.3% of the property’s land value for owner-occupiers

- $1,500 plus 1.1% of land value for investors

To give an example, let’s imagine your child is buying a house in Sydney for $1.5 million with a land value of $900,000. They can now choose between paying:

- Upfront stamp duty of $66,700; or

- The annual property tax – which, in 2022-23, would be $3,100

What about existing first home buyer stamp duty concessions?

There will be no changes to existing stamp duty concessions for first home buyers (which are available on purchases up to $800,000).

Will your child be better off paying stamp duty or a property tax?

Unfortunately, there isn’t one answer, as it depends on individual circumstances, so it’s a good idea to seek independent financial advice.

The NSW state government also has an online calculator to help first home buyers assess their options.

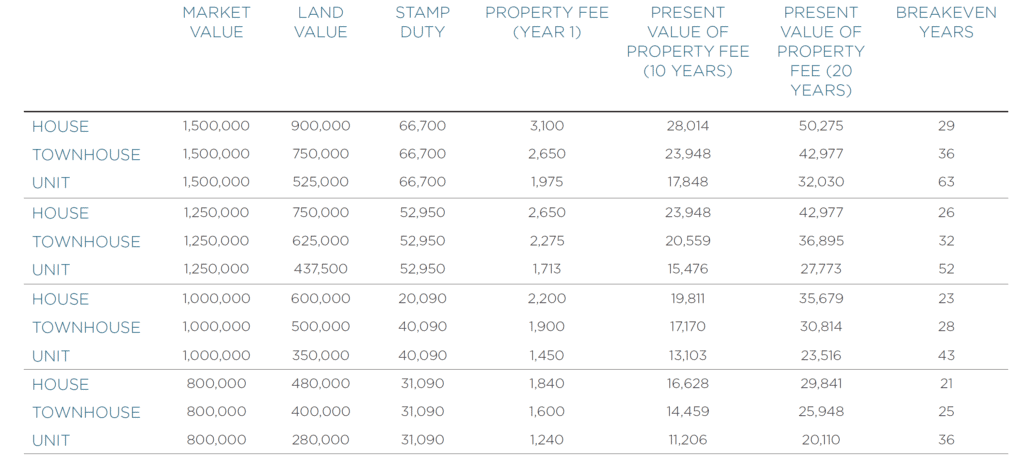

That said, in the above example, your child would need to pay the annual tax for 29 years before they’d equal the cost of the upfront stamp duty paid, according to NSW Treasury modelling. Bear in mind that the median holding time in NSW is 10 years.

As a result, many first home buyers will pay less tax overall if they opt for the smaller annual tax rather than stamp duty as the table below shows.

Stamp duty comparisons

As always, it is good to speak to an adviser about your individual situation.

This article was first published in Personal Wealth Adviser Issue 5.