The small business CGT concessions offer valuable tax savings for business sales, but there are major changes to the rules for selling shares have added extra tests that will be difficult to satisfy.

What was the problem with the old rules?

In an effort to overcome perceived abuse of the old rules dealing with selling shares and units in business entities, the Government has implemented an expanded series of tests for sales on or after 8 February 2018 as part of the basic conditions for applying the CGT concessions.

The problems identified with the previous rules were that they potentially allowed:

- A shareholder / unitholder to own between 20% and 40% of one or more large business entities and apply the CGT concessions to a sale of their shares.

Example 1 – multiple stakeholders in a large business entity

Pat, Josh, Mitch and Nathan each owned 25% of Last Blast World Pty Limited, which carried on a sporting merchandise business. They were able to sell their shares in LBW to IPL Holdings for $20m in total, but as none of them were treated as controlling LBW they would each have to count only the value of their 25% stake ($5m) when applying the $6m net asset value (NAV) test, giving them a reasonable chance of applying the concessions.

As will be seen below, the situation under the new rules will be vastly different.

- An individual to start up or acquire a small business so as to satisfy in their own right the $2m ‘small business entity’ turnover test, where it is clear they will fail the $6m NAV test.

Example 2 – buying a small business when selling out of a larger business

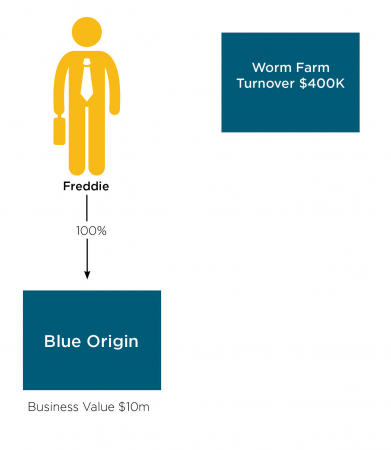

Freddie owned 100% of Blue Origin Pty Limited which carried on a business of corporate wellness coaching, and sold all of his shares to Todd for $10m. In the year of the sale Freddie acquired a worm farm that supplied local anglers with bait, and had an annual turnover of $400,000. That makes Freddie a “small business entity”, and he could claim the CGT concessions for the Blue Origin share sale.

What has changed?

There are now three additional basic conditions to be met for a share sale.

Condition 1 – Modified active asset test

This test applies only to multi-layer structures, and changes the way in which the active asset test applies to selling interests in an entity that in turn holds an interest in another entity carrying on a business, i.e. selling at the “top” of the structure.

The active asset test requires the market value of active assets held by entities in which interests are sold to be at least equal to 80% of the total market value of assets for a period equal to the lesser of 7.5 years or one-half of the period during which the share or units were held.

The modified test looks through interposed entities to their proportionate interests in the market values of assets held by the underlying operating entities.

The operating entities must meet either the $2m turnover test or the $6m NAV test using a modified control test where 20% or more is enough to establish control.

The taxpayer must also be a “CGT concession stakeholder” in the operating entity, i.e. they or their spouse hold an interest of at least 20%.

There is quite a lot to this test, and it can only be readily understood using an example.

Example 3 – selling shares under a multi-layer structure

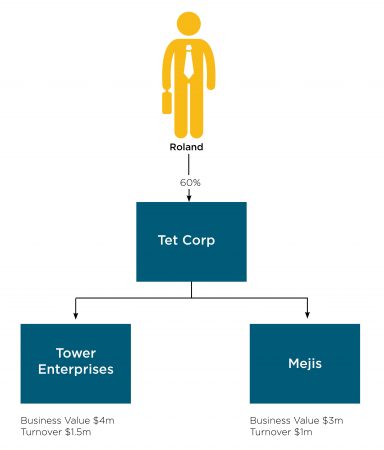

Roland owns 60% of Tet Corporation, which owns 50% of Tower Enterprises Pty Limited (a travel agency valued at $4m with turnover of $1.5m) and 30% of Mejis Pty Limited (a horse stud valued at $3m with turnover of $1m).

The steps to be followed in applying this condition are:

- Identify which entities are aggregated under the modified control test, in this case all three companies, as Tet Corporation has an interest of >20% in both later entities.

- Calculate Roland’s indirect interests – 30% for Tower Enterprises (60% x 50%) and 18% for Mejis (60% x 30%).

- Calculate the market values of assets of the operating entities for the modified active asset test – $1.2m for Tower Enterprises ($4m x 30%) and $540,000 for Mejis ($3m x 18%).

- Calculate the active asset percentage, based on the fact that the indirect interests in assets of Mejis are not treated as active as Roland’s indirect ownership is less than 20% and he is therefore not a CGT concession stakeholder of Mejis. As the only active asset to be counted is the indirect interest of $1.2m in Tower Enterprises, and the total aggregated asset value is $1.74m, the active asset percentage is 69%.

- Assuming this is representative of the percentages that applied during the time that the structure was in place, Roland’s shares in Tet Corporation would not satisfy the modified active asset test, and the CGT concessions in Division 152 would not be available to him.

- Even if the 80% requirement was satisfied, the $6m net asset value threshold would have been breached, as both Tower Enterprises and Mejis are “controlled” by Tet Corporation, and the aggregated net asset value would be $7m. Similarly, neither company is a CGT small business entity as, while individually they have turnover of less than $2m, aggregated turnover is $2.5m.

Condition 2 – Carrying on a business prior to the CGT event

This takes a very prescriptive approach to applying the $2m turnover test when shares or units are sold, and becomes relevant if the $6m NAV test cannot be satisfied.

There are two parts that, when combined, make it more difficult to use the $2m turnover test.

- The taxpayer must have carried on a business just prior to the CGT event, so they cannot buy or start a small business after selling the shares in the existing business.

- The company must itself have satisfied the $2m turnover test for the year.

Returning to Example 2 above, if Blue Origin’s turnover exceeded $2m he would fail the test.

If, however, Blue Origin’s turnover was $1.5m, and the worm farming business (turnover $400,000) was acquired before the share sale, Freddie may scrape in just under the $2m threshold.

Condition 3 – Company must satisfy $2m turnover test or $6m net asset value test

The company must satisfy either the $2m turnover test or the $6m NAV test, in each case if there is a multi-layer structure applying the modified control percentage of 20%. This is all aimed at preventing taxpayers from using the concessions when selling shares in a large business.

Returning to Example 1, LBW clearly fails the $6m NAV test, so it would need to look at the $2m turnover test, and each individual shareholder would need to satisfy Condition 2, i.e. to carry on a business in their own right and have aggregated turnover no more than $2m.

As LBW’s turnover was $4m, and none of the individual shareholders were carrying on a business, under the new rules they could not apply the CGT concessions.

Conclusion on CGT concessions

The changes to the small business CGT concessions are significant for share sales, and are intended to close off perceived loopholes. This will need more planning to maximize access to the CGT concessions, or if they cannot be used then to review other approaches that will provide the most tax-effective outcomes for the business owners.