Despite a challenging backdrop of inflation fears, geopolitical unrest and market volatility which has seen the number of IPOs fall 54% compared to prior year, the resources sector was able to maintain its dominance of the IPO market in 2022. There were 70 listings from the sector, comprising 63 Materials companies and 7 Energy companies. This represented a significant proportion of the total IPO market for the year, making up 80% of all listings in 2022 (2021: 59%).

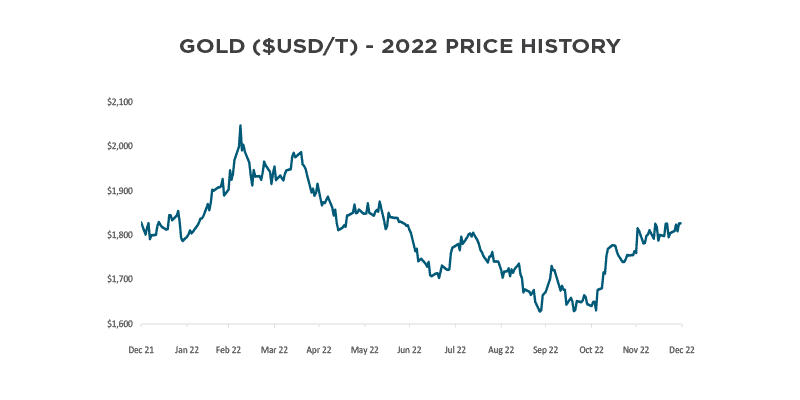

It was a year of mixed signals for the resources sector. 2022 started with strong oil and iron ore prices and a stable gold price, however growing fears that inflation would be structural rather than transitory spooked markets and there was an expectation that there would be a flight to the safety of gold. This didn’t eventuate, which has surprised many, with the USD gold price falling in the middle of the year before climbing back towards the end of the year. The proportion of gold companies listing in the year fell, however it did remain the most sought after commodity of companies entering the market in the year.

There was a noticeable drop off in the number of companies completing IPOs from April onwards, as market uncertainty heightened. This affected all sectors, including resource companies. A number of companies holding projects in high-demand subsectors such as gold, lithium and other battery metals proceeded with their listings, despite the backdrop, to varying levels of success post-listing.

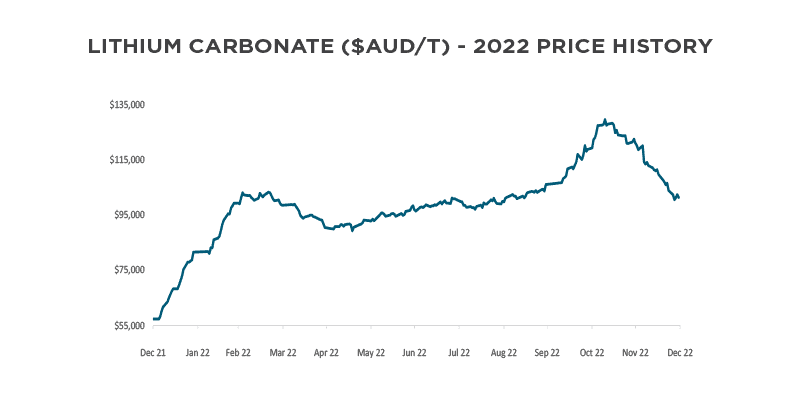

Of the resource company listings, 63 were in the materials subsector and of these, there were 11 lithium explorers, and a further 4 who listed lithium as one of the commodities under exploration. The largest resources IPO in 2022 was Leo Lithium Ltd, which listed on 23 June 2022 and raised $100 million. While there has been increased interest in lithium projects and other battery metals as focus turns to greener alternatives, gold projects remained the most sought after of materials companies in the year. Both gold and lithium IPOs have faced the same struggles maintaining share price over the course of the year with new listings focusing on gold recording a 5% loss at year end and those on lithium reporting a marginal 1% gain. This is surprising considering the publicity around battery metals and expected future demand; however it indicates any potential upside is priced into the companies at IPO, with investors cautious there might not be major gains in the future.

As in previous years, Western Australia dominated the sector, with 51 of the 70 resources listings coming from the state, followed by 8 in New South Wales. Queensland had six listings, a decline from last year. Queensland’s main commodity is coal and there are fewer projects focused on the current hot commodities such as lithium and other battery metals.

On top of the challenging market conditions, a major concern facing resources companies looking to list has been the cost considerations. Supply chain pressures and labour costs have resulted in projects and exploration expenditure increasing considerably since the start of 2022, which has meant that the value of capital raised in an IPO is not going nearly as far as it did two years ago.

Despite the lower bang for your buck, an IPO is often the best option available to resource companies to raise capital and take a project forward. Companies exposed to the growing global demand for metals integral to the production of batteries for electric vehicles have fared relatively well. This includes metals such as graphite, nickel and copper. While these don’t seem to have had their time in the sun yet, in the same way that lithium has, it is likely we will see more activity from companies in these areas over the next year or two.

Resources companies make up a substantial proportion of the pipeline of IPOs for 2023. At time of writing, there are 10 registered upcoming floats and of these, 9 are resources companies. It’s likely that the difficult market and high costs experienced in 2022 have put some IPO plans on hold, however we could potentially see a number of companies who had delayed their listing plans come to market in 2023 if there are signs the market is stabilising.

A possible headwind for the resources sector is the government proposal to introduce pricing caps in the energy sector. While in the short term this can achieve certain political aims, over the longer term it reduces the incentive for companies to re-invest, and ultimately affects the stability of the market. The talk and actions in this space doesn’t seem to have had an immediate impact, these markets are still running very hot and there is no sign as yet of a slowdown. However if such policies are pursued long term it is likely to have a noticeable impact on share prices of companies in the energy sector.

Overall, resource companies are approaching the year ahead with a degree of confidence as general sentiment seems to be that the market will stabilise during the year. The future for those companies exposed to the alternate energy transition looks bright, while those focused on more traditional sectors such as oil and iron ore are still in a strong position, particularly as China comes out of its strict COVID lockdowns. We expect that lithium, gold, and oil and gas will continue to be the dominant sectors in the short term, but how long this will be the case remains unclear.

This article was first published in the 2023 IPO Watch Australia Report.