On 22 February 2021, Treasury released a consultation paper that outlines a proposal to increase the annual revenue thresholds that determine the financial reporting requirements for charities registered with the Australian Charities and Not-for-profits Commission (ACNC).

Charities and other interested stakeholders are encouraged to have their say and share their views on the proposal before the consultation period closes on 21 March 2021.

The proposal is in response to the independent legislative review of the ACNC that was completed in 2018. One of the recommendations in the final report was the following:

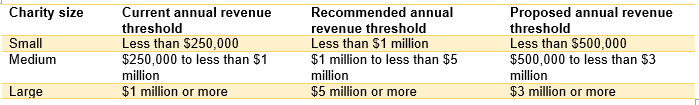

“Registered entities be required to report based on size…, with thresholds of less than $1 million for a small entity, from $1 million to less than $5 million for a medium entity and $5 million or more for a large entity.”

With the support of the Commonwealth Government, the recommendation was put to the Council on Federal Financial Relations (CFFR). Consequently, the CFFR requested that a framework for increasing harmonised financial reporting thresholds across jurisdictions be announced by 30 June 2021. As part of establishing this framework, feedback is being sought on the issues associated with the proposed annual revenue thresholds.

The proposed change

As shown in the table below, the proposed thresholds are higher than those currently in place, but lower than what was recommended in the findings stemming from the ACNC legislative review. This is to balance a reduction in regulatory red tape while preserving transparency to promote accountability, public trust and confidence in the charity sector.

The expected benefits and challenges

The consultation paper sets out the expected benefits of increasing the reporting thresholds which includes reduced administrative costs for almost 6,800 charities that would move to a lower threshold. Charities that move from the medium category to the small category (approximately 3,300 charities) would no longer be required to produce reviewed financial reports, while those that move from the large category to the medium category (approximately 3,500 charities) would no longer be required to produce audited financial reports.

The consultation paper goes on to explain how accountability and transparency will be maintained for those charities that would no longer have to submit reviewed financial reports to the ACNC due to a change in thresholds. These charities would still be required to lodge an Annual Information Statement, however other measures to address concerns regarding accountability and transparency include:

- Improved reporting on charity activities, including mandating the reporting of related party transactions.

- Continued monitoring of compliance with the ACNC Act.

- Ensuring that all Annual Information Statements are publicly available on the Charity Register.

- Continued sharing of data from ACNC-registered incorporated associations to States to allow States to continue regulating these entities.

The key challenges associated with implementing the proposed reform are discussed in the consultation paper. In summary, these relate to:

- Aligning the timing of the proposed changes so as not to jeopardise the significant harmonisation progress made to date across jurisdictions for registered charities that are also incorporated associations.

- What it means if different reporting thresholds exist for ACNC-registered and non-ACNC-registered incorporated associations.

- The possibility of creating additional regulatory burdens for charities that undertake fundraising activities (and are therefore required to lodge annual financial reports), although it is expected that the reform would not do this.

- The interaction of the increased thresholds with the Australian Accounting Standard Board’s current project to overhaul the not-for-profit financial reporting framework which will only be finalised in a few years.

Be heard and have your say on reporting thresholds

Charities and other interested stakeholders are strongly encouraged to share their views about the proposed changes to the annual revenue thresholds. This can be done by visiting Treasury’s website to read the consultation paper and submitting your responses to the six questions posed via the email address provided. Alternatively, respondents can complete a quick survey that takes about five minutes to complete.

The consultation period closes on 21 March 2021.

To access the consultation paper and link to the short survey, please click here.