What are the foreign surcharges?

Many of you may be aware, Surcharge Purchaser Duty and Surcharge Land Tax (together, the foreign surcharges) were introduced by the NSW government in the 2016 NSW Budget. The foreign surcharges apply to foreign persons who are purchasing NSW residential real estate or who own residential land in NSW.

As their names suggested, these taxes are in addition to the usual transfer duty for purchasers and the annual land tax for landowners.

There is no tax-free threshold for these foreign surcharges, this means ‘foreign person’ landowners need to pay a surcharge on the taxable value of all residential land that they are purchasing (Surcharge Purchaser Duty) or they own (Surcharge Land Tax).

Who is a ‘foreign person’ for the foreign surcharges?

The rules for determining whether a person is a ‘foreign person’ are complicated. The Revenue NSW website has helpfully summarised that:

You’re generally considered a ‘foreign person’ unless:

- you’re an Australian citizen; or

- you’ve lived in Australia for 200 days or more in the 12 months prior to the taxing date of 31 December, and you’re:

- a permanent resident of Australia, or

- a New Zealand Citizen, who holds a subclass 444 visa.

Do foreign surcharges apply to landholder corporations and trusts?

Yes. The foreign surcharges can also apply to the landholder corporations or trusts in which a foreign person holds a ‘substantial interest’ (of at least 20%) or a number of foreign persons hold an ‘aggregated substantial’ interest (of at least 40%).

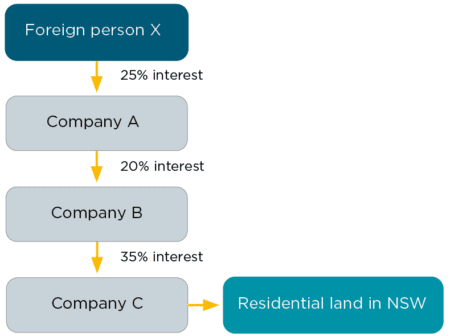

In order to determine the foreign person(s)’ % of interest in the landholder corporations or trusts, you must trace an interest through multiple layers of corporations and trusts in a holding structure and identify to the ultimate individual holder(s). Consider the following flowchart taken from Revenue NSW Ruling G009:

As foreign person X has a substantial interest in Company A, Company A is a foreign person. As Company A has a substantial interest in trust B, foreign person X is deemed to hold the 20% interest in Trust B, making Trust B (the trustee of Trust B) a foreign person. In turn, Trust B has a substantial interest in Company C, making Company C a foreign person, as foreign person X is taken to hold the 35% interest in Company C.

Ok, I can see how the rules apply to corporations and fixed trusts. What about my discretionary trust?

Typically, the trustee of a discretionary trust has an absolute discretion to distribute the trust’s income and capital to the trust’s potential beneficiaries.

Although these potential beneficiaries do not have an entitlement to the income or capital of the trust until the trustee decides to distribute to them, each potential beneficiary of the discretionary trust is deemed to hold the maximum percentage of interest in the income and property of the discretionary trust.

Due to the broad range of the potential beneficiaries described in a typical discretionary trust’s deed, it is deemed that there could be one or more ‘foreign person’ beneficiaries. Consequently, your discretionary trust will be deemed to have a ‘foreign person’ trustee.

In practice, where a discretionary trust directly holds or buys NSW residential land, or holds an interest in another corporation or trust that has an interest in NSW residential land, the trustee of the discretionary may be liable for the foreign surcharges.

We have seen some real-life examples where Revenue NSW issued foreign surcharge assessments to trustees of discretionary trusts on this basis.

Is there a way for my discretionary trust to avoid getting caught by the foreign surcharges?

Yes. If it is a permissible power under the trust deed, the trustee should consider making an irrevocable trust deed amendment to exclude ‘foreign person’ to be a potential beneficiary.

Key takeaway

If you have a discretionary trust or are considering to set up one, we recommend you speak with your HLB adviser about how the effect of foreign surcharges on your trust.