Employee Share Schemes (ESS) continue to cause difficulties for companies and ESS interest recipients, as outlined below.

Recent changes

The only enacted change in the past year is that a ‘cessation of employment’ has been removed as a deferred taxing point for an ESS interest from 1 July 2022.

Foreign aspects of ESS

The application of Div 83A to circumstances having a foreign aspect require consideration of the residency of the individual, what role the ESS interests relate to, and the source of that income.

Temporary residents:

Div 83A applies to ESS interests relating to employment in Australia (although not to services provided outside of Australia).

Australian (non-temporary) residents with foreign service income:

In the absence of a double tax treaty that may provide concessional treatment, Australian (non-temporary) residents will be assessed on discounts received on ESS interests relating to foreign service.

Foreign residents being directors of Australian resident companies:

Caution should be had by foreign resident directors of Australian resident companies when determining the tax treatment of ESS interests received. Although the foreign resident director may not physically be in Australia, they still may be assessed under Div 83A. Whether the foreign resident director is receiving the ESS interests in their capacity as a director or in another capacity (e.g. an in country operations manager) may have differing Australian tax implications.

Salary sacrifice/preserving cash

Recently (particularly in the uncertain times at the start of COVID-19), more consideration has been given to providing ESS interests, not just as bonuses but in substitution for net salary (or wages). That is, the company has already calculated and paid/will pay PAYG withholding and superannuation contributions on the gross salary.

This can be problematical when:

- issuing shares commensurate with the net salary foregone but calculated at a discount to market (which would result in an ESS discount and possibly an unfunded tax liability); and

- the pay period has since passed and the issuing of the ESS interest is at a later time (possibly in a subsequent income year), i.e. at what time is the ESS interest value calculated, and is it different to the net salary foregone (noting again that this may result in an ESS discount and unfunded tax liability)?

Payroll tax

Critically:

- When should the value of the ESS interests be determined (and the timing of any liability)?

- What method should be used to value the ESS interests?

Whether there is a payroll tax liability will also be contingent on the tax-free threshold allowable to the company, which is dependent on:

- the level of other taxable wages of the company

- whether the company is grouped with other entities, and

- whether the company (or other grouped entities) operates in more than one state or territory, and where they may be.

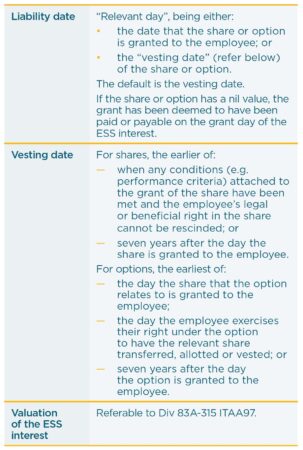

Table 1 sets out the critical dates to be considered to determine the value of taxable wages attributable to ESS interests.

Table 1. Definitions of critical dates

Final comment

There is every chance that the value for Div 83A, AASB 2 and payroll tax could be different. It is best to know the potential impacts on this prior to grant date, or better still, as part of issuing ESS interests.

This article first appeared in the Spring 2022 issue of HLB Mann Judd Perth’s Client Alert.