In October 2023, to support the Australian Government’s commitment and proposed policy to implement mandatory climate-related disclosures, the Australian Accounting Standards Board (AASB) released an exposure draft containing Australia’s first sustainability reporting standards that focus on climate.

The content of the exposure draft, ED SR1 Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information (ED SR1), is largely aligned with the IFRS Sustainability Disclosure Standards issued by the International Sustainability Standards Board (ISSB) to date, namely:

- IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1)

- IFRS S2 Climate-related Disclosures (IFRS S2).

ED SR1 contains three proposed Australian Sustainability Reporting Standards (ASRS):

- ASRS 1 General Requirements for Disclosure of Climate-related Financial Information (ASRS 1);

- ASRS 2 Climate-related Financial Disclosures (ASRS 2); and

- ASRS 101 References in Australian Sustainability Reporting Standards.

The proposed effective date of ED SR1 is 1 July 2024 however it is Treasury that will determine which entities will have to make climate-related disclosures and when.

IFRS S1 Compared to ASRS 1

The objective of IFRS S1 is to disclose information about the sustainability-related risks and opportunities that could reasonably be expected to affect an entity’s prospects. It is a base standard, designed to be applied together with any other IFRS Sustainability Disclosure Standard, and contains all the foundational concepts and requirements when it comes to disclosures on sustainability topics not addressed by another IFRS Sustainability Disclosure Standard.

In terms of objective, ASRS 1 only requires identification of and disclosures about material climate-related risks and opportunities. The impact of this is that the proposed Australian disclosures do not extend to all sustainability topics but are, instead, limited to climate only. This is because the Australian Government has decided to mandate only climate-related financial disclosures at this stage. While IFRS S1 was developed with for-profit entities in mind, the AASB envisions that ASRS 1 (and any other ASRS, including ASRS 2) should be capable of being applied by both for-profit and not-for-profit entities. Sector neutrality has been achieved by proposing tweaks to the objective paragraphs to include terminology relevant to not-for-profit entities.

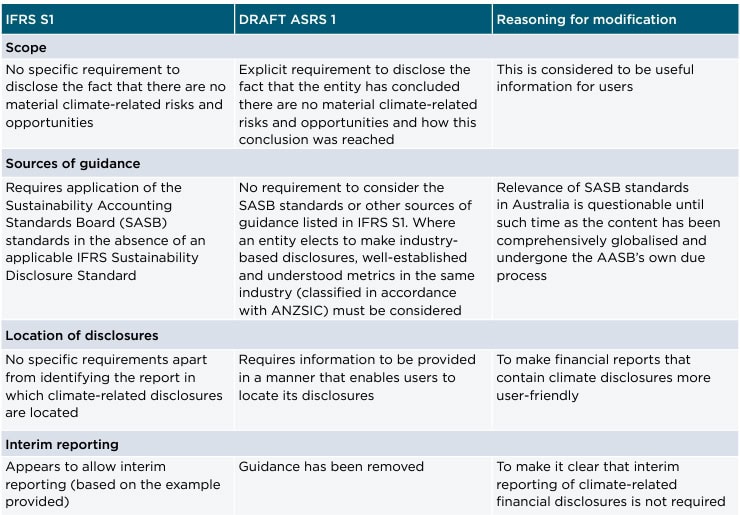

Other differences between IFRS S1 and draft ASRS 1 are summarised in the table below.

IFRS S2 compared to ASRS 2

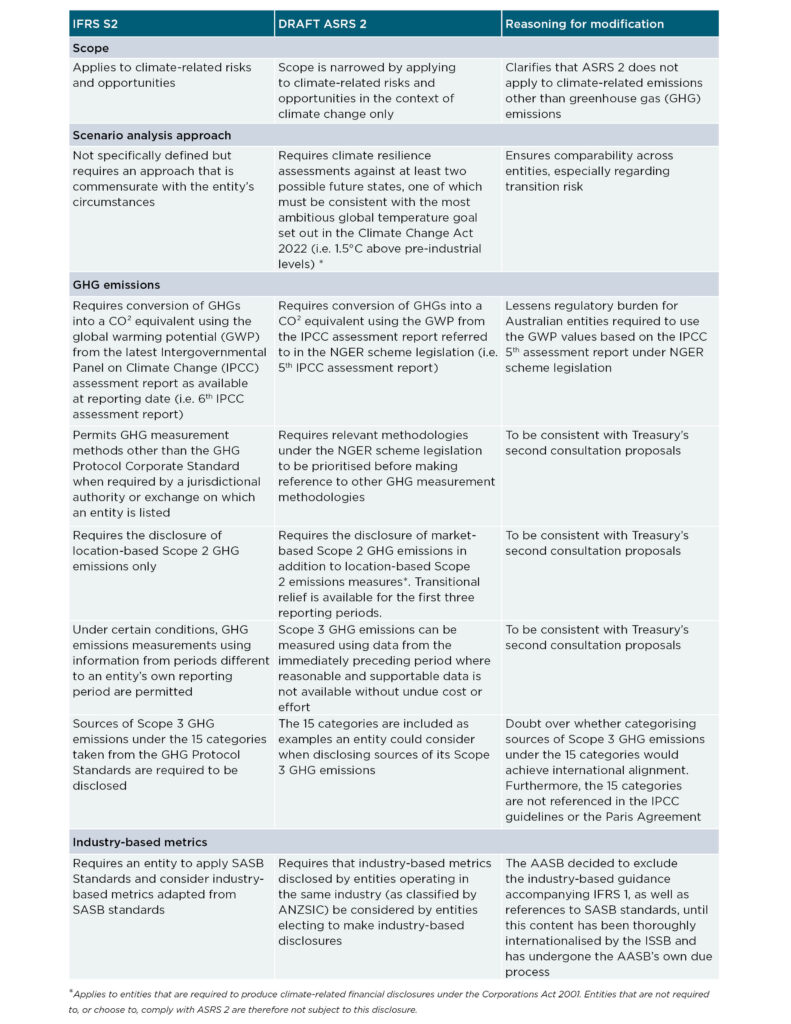

2 IFRS S2 is a topic-specific standard, focusing on material physical and transition risks and opportunities related to climate. ASRS 2 is based on IFRS S2 but has been modified in certain respects to cater for the Australian context. Since ASRS 1’s scope has been limited to climate, many of the ASRS 2 requirements surrounding governance, strategy and risk management were consequently duplicated. The proposed solution is to remove duplicated requirements in ASRS 2 and use cross-references to the corresponding paragraphs in ASRS 1 to direct users to the relevant requirements. Differences between IFRS S2 and draft ASRS 2 are outlined in the table below:

Commencement date for climate reporting

ED SR1 proposes an effective date of 1 July 2024. However, the first reporting period an entity captured by the reforms is required to apply these ASRS standards will depend on Treasury.

Just recently, following Treasury’s exposure draft legislation in January this year, the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024 was introduced into Parliament. If enacted, it is this Bill that will mandate climate reporting for entities that lodge financial reports under Chapter 2M of the Corporations Act 2001 and meet certain size thresholds or have emissions reporting obligations under NGER scheme legislation. The Bill delays the initial proposed commencement date of climate reporting obligations by at least six months. This means mandatory climate disclosures will now be phased in from 1 January 2025 at the earliest. However, this will be subject to the Bill passing through both Houses of Parliament before 2 December 2024. If passed later than this but before 2 June 2025, the commencement date will likely be 1 July 2025. The entities subject to the reforms have not changed under the Bill (compared to the exposure draft legislation). For details on the type and size of entity that will need to prepare climate reports in the near future, refer to our previous article.

Do not ignore the changes that are coming

While Group 2 and Group 3 entities have some time before mandatory climate reporting affects them, there is much to think about and do considering this is the most significant change in corporate reporting in Australia since the adoption of International Financial Reporting Standards (IFRS) in 2005.

Regardless of size, entities should consider their supply chain. As Group 1 and Group 2 entities start to measure and report their greenhouse gas emissions, Scope 3 could become integral to their emissions reduction strategies, prompting smaller entities that find themselves in Group 1 and Group 2 entities’ value chains to provide their emissions data earlier than required by legislated reporting.

Finding and dedicating resources to ensure climate reporting obligations are understood and met is anticipated to be a challenge, especially in the initial stages as everyone upskills in this space. Entities that are proactive in this regard will no doubt reap the benefits later down the track.

This article was first published in Issue 19 of The Bottom Line.