On 12 January 2024, Treasury released exposure draft legislation that confirms the way forward for mandatory climate-related financial disclosures in Australia. Entities should start preparing for the most significant corporate reporting reforms since the adoption of IFRS Standards in 2005.

The draft legislation follows two Treasury consultations, and the release of Exposure Draft ED SR1 Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information (ED SR1) by the Australian Accounting Standards Board (AASB) in October 2023.

The draft legislation is broadly in line with Treasury’s earlier design consultation. The effect of the legislation, if passed through Parliament, is amendments to the Corporations Act 2001 and the Australian Securities and Investment Commission Act 2001 that would create the Australian framework for mandatory climate-related financial disclosures.

A summary of the key aspects of Treasury’s exposure draft legislation is provided below.

Which entities are captured?

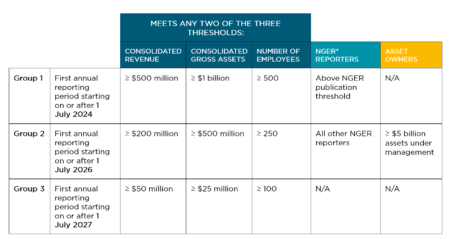

A three-phased approach will be used to implement mandatory climate-related financial disclosures for entities that submit financial reports under Chapter 2M of the Corporations Act 2001 and fall within any of the three categories below:

*National Greenhouse and Energy Reporting

Under amended legislation, companies limited by guarantee with consolidated (if applicable) annual revenue of $1 million or more and which meet the other sustainability reporting thresholds will also be subject to mandatory climate-related disclosures.

Consolidated revenue, gross assets and the value of assets must be determined in accordance with Australian Accounting Standards applicable at the time. When calculating employees, part-time employees must be included as an appropriate fraction of a full-time equivalent employee.

Group 3 entities will be subject to a materiality exemption where they do not have any material climate-related risks and opportunities in the relevant financial reporting period. A statement to this effect will need to be disclosed and subject to audit. Materiality in this context will be assessed in line with the Australian Sustainability Reporting Standards (ASRS) as issued by the AASB.

Which entities are exempt?

The following entities will not be required to make climate-related financial disclosures:

- Small and medium entities that fall below the relevant size thresholds (unless they are NGER controlling corporations); and

- Entities that are not required to lodge financial reports under Chapter 2M such as charities registered with the Australian Charities and Not-for-profits Commission (ACNC) and entities exempt by ASIC class order relief.

Where will climate disclosures be made?

Climate disclosures will be included in a sustainability report within an entity’s annual report. This is in addition to the currently required directors’ report, financial report and auditor’s report. The sustainability report will consist of:

- a climate statement prepared under ASRS, including the Group 3 materiality exemption, if applicable

- notes to the climate statement (if any)

- a directors’ declaration regarding the statement and notes

Entities are encouraged to make use of an index table within the annual report to allow for easy navigation to the climate-related disclosures.

When will climate disclosures be made?

In terms of timing of reporting, lodgement of the sustainability report with ASIC will follow existing annual financial reporting timing requirements under the Corporations Act 2001.

What must be disclosed?

Entities captured by the corporate reporting reforms will make climate disclosures in accordance with Australian Sustainability Reporting Standards (ASRS) issued by the AASB.

The AASB issued ED SR1 in October 2023 which contains three proposed ASRSs including ASRS 1 General Requirements for Disclosure of Climate-related Financial Information and ASRS 2 Climate-related Financial Disclosures. These ASRSs are based on the International Sustainability Standards Board’s (ISSB) IFRS S1 and IFRS S2, with adaptations for the Australian market, including taking a climate-first approach.

ED SR1 is currently open for comment and feedback until 1 March 2024. It is anticipated that that the proposed ASRSs will be finalised in time to apply to financial reporting periods commencing on or after 1 July 2024.

What about assurance requirements?

Similar to financial reports, climate disclosures will be subject to assurance requirements. Financial auditors will be responsible for issuing assurance reports, making use of technical climate experts where necessary.

The scope and extent of assurance requirements will be phased in, commencing with limited assurance over Scope 1 and Scope 2 emissions from years commencing 1 July 2024 onwards, and ending with reasonable assurance over all climate disclosures made from years commencing 1 July 2030 onwards.

The Australian Auditing and Assurance Standards Board (AUASB) is in the process of developing local assurance standards for climate-related financial disclosures that will include the pathway for phasing in requirements over time in line with Treasury’s proposals.

What’s next?

Treasury is seeking feedback on the exposure draft legislation by 9 February 2024. Furthermore, feedback is also being sought on a six-month deferral of the commencement date for Group 1 entities and whether such a deferral would improve the quality of climate reporting during the transition year.

In the meantime, entities can do the following to start their climate reporting journey:

- Familiarise themselves with the exposure draft legislation, and understand if, when and how the proposals affect them

- Understand the types of disclosures that will be required under ED SR1 as this will inform the additional processes, data and resources needed to make these disclosures

- Provide feedback to the AASB on ED SR1 before 1 March 2024 – the online survey serves as an easier way for entities to have their say

- Start to identify capability needs within the organisation, especially in relation to measuring and reporting emissions data, and look to upskill or partner where necessary.