On 17 September 2024, the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024 became law, phasing in mandatory climate-related disclosures for in-scope companies from 1 January 2025.

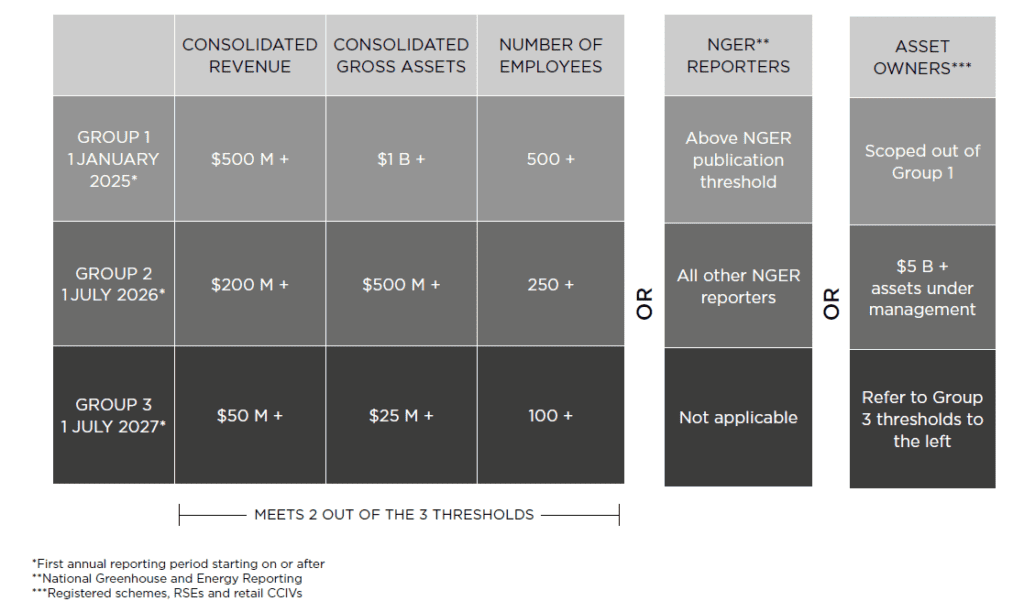

A three-phased approach will be used to implement mandatory climate-related financial disclosures for entities that submit financial reports under Chapter 2M of the Corporations Act 2001 and fall within any of the categories below:

HLB Mann Judd has prepared a guide for Group 3 entities which outlines the disclosure requirements, location of disclosures and a high-level example of what a timeline could look like for entities that are required to commence climate reporting for financial years beginning on or after 1 July 2027 (i.e., FY28 for June and December reporters). We also outline next steps to start planning in advance of your first reporting period.

For many Group 3 entities, this will be their first interaction with sustainability-related disclosures. Adequately preparing for this transformative process will take time.

Developing a reporting timeline will serve as a helpful starting point to get things moving. This involves understanding your mandatory reporting requirements and when they commence, and then mapping out the steps you need to take to ensure you will be ready to begin reporting. Taking this proactive approach will inform your engagement process across the business and help identify and plan the resources needed.

Not a Group 3 entity?

Regardless of size, entities should consider their supply chain. As Group 1 and Group 2 entities start to measure and report their greenhouse gas emissions, Scope 3 could become integral to their emissions reduction strategies, prompting smaller entities that find themselves in Group 1 and Group 2 entities’ value chains to provide their emissions data earlier than required by legislated disclosures.

HLB has also developed a guide for Group 2 entities here.

We recommend reaching out to an HLB Mann Judd adviser should you wish to learn more.