It was a year of contrasts for the resources sector. While some commodities performed very strongly, others surprisingly struggled.

Iron ore was one of the few areas that did well. Prices remained strong throughout the year, and well above the cost of production. Demand from China for iron ore has supported prices, although whether this level can be sustained in 2024 remains to be seen.

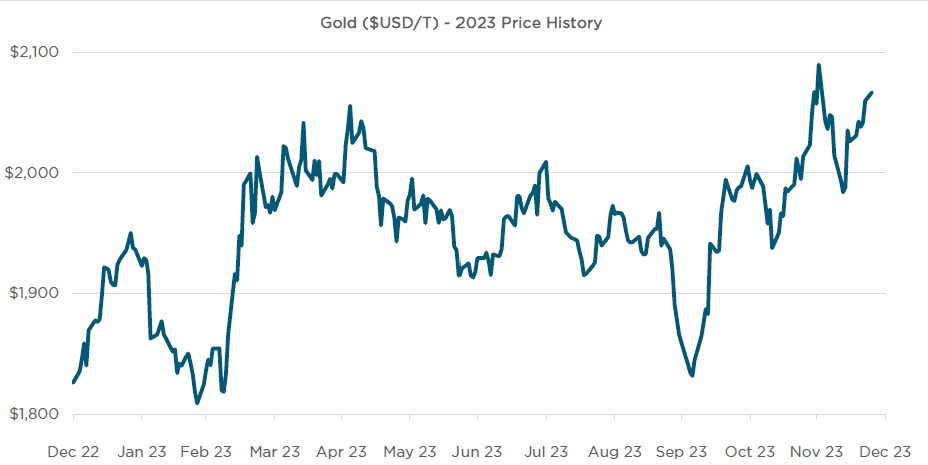

On the other hand, the performance of gold continued to be very muted throughout 2023. The price tried several times to break through the US$2000 per ounce mark, and the general view is that if it can stay above this level for a sustained period, it would continue to rally. Despite gold historically being typically viewed as a safe haven by investors during inflationary periods, this was not the case in 2023.

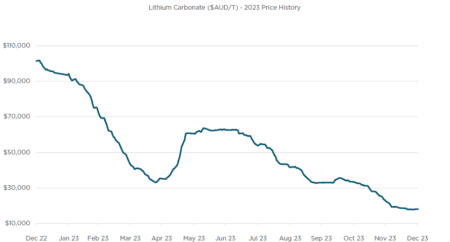

Another surprise is the collapse in the price of nickel, despite its crucial role in rechargeable batteries. It finished the year at around half its initial value. This decline is largely attributed to oversupply in the nickel market. Additionally, other metals such as zinc and lithium have also experienced decreases, while copper has remained steady, though not at the levels anticipated at the beginning of the year.

Across the board, producers have struggled with rising costs during the past 12 months. Labour costs have increased sharply throughout the resources sector, particularly in Australia which has been competing with cheaper producers overseas. For producers of those metals which have experienced a significant drop in price throughout the year, this has brought into question the viability of current operations and there has been a number of instances recently where producers have announced plant closures or voluntary administration.

Another significant factor affecting the resources sector has been the ongoing cash rate increases from the Reserve Bank of Australia (RBA). With investors able to access a risk-free return from banks of 5%, there has been a shift in capital out of the share market into term deposits and the like. As a result, it has become significantly harder to raise funds in the IPO market which has impacted junior explorers who have few other alternatives for raising capital.

Of the 32 IPOs in 2023, 24 have been from the resources sector and the majority of these were lithium producers (8) followed by gold (5) and rare earths (6). Just one was in the Energy sector – hydrogen producer Gold Hydrogen Limited (ASX: GHY) which listed in January.

Most of these resources listings were well subscribed, with just two not achieving their targets. However the amounts raised were small, with 19 of the 24 listings seeking $10 million or less.

During the boom times, acquiring drills and rigs required long lead times. However, with some drillers seeking work, it may indicate a slowdown in the market.

Looking ahead to 2024, the current environment indicates it will continue to be a tough year for the resources sector, particularly if the RBA continues to increase interest rates. However if gold prices manage to break through the US$2000 level, or lithium goes on a run, this might act as a catalyst for greater interest in the junior explorers.