Headwinds for the IPO market

The 2022 initial public offerings (IPO) market in Australia had a challenging second half of the year. A number of contributing factors saw IPOs drop significantly, with just 28 listings between July and December compared to 59 in the first half of the year.

Download HLB Mann Judd’s annual IPO Watch Australia Report, an analysis of IPO activity over the past 12 months. The report addresses key data points and explores themes arising from market activity.

2023 Report Summary

- 87 new listings on the Australian Stock Exchange (ASX) in 2022, compared to 191 listings in 2021.

- IPOs raised $1.07 billion compared to the record-breaking amount raised in 2021 of $12.33 billion.

- Average funds raised fell from $64.54 million in 2021 to $12.34 million in 2022. The decrease in average funds raised can be largely attributed to the make-up of listings in the year.

- A total of 12 industry sectors saw new listings in 2022, a fall from 21 in the previous year.

- New listings in the Materials sector dominated the market, representing 63 of the 87 new listings.

* Large cap companies are defined as those with a market capitalisation in excess of $100 million. Small cap, companies are defined as those with a market capitalisation of $100 million or less. All data excludes property trusts.

About IPO Watch Australia

First published in 2004, IPO Watch Australia is a benchmarking-based report. The research, led by HLB Mann Judd Perth, analyses Australian listing activity. The primary report is released in January each year, analysing IPO activity over the previous 12-month period. A short-form report is published in July and it focuses on market activity for the first six months of the year (IPO Watch Australia Mid-Year Report). The reports are authored by Corporate & Audit Services Partner, Marcus Ohm.

This year's IPO Watch Australia Report includes commentary and data analysis on the following:

- Share price performance

- Sector analysis

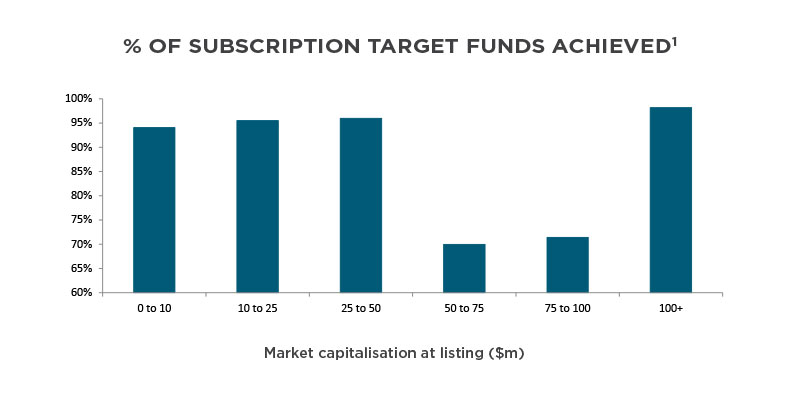

- IPO subscription rates

- Review of activity by quarter

- Resources sector performance

- The road ahead for 2023.

How HLB can help

We offer a comprehensive range of professional services to listed clients and companies considering IPO, including:

- Independent limited assurance reports on historical and forecast financial information;

- Analysis and advice on feasibility and alternatives to an IPO;

- Pre-IPO diagnostic reviews;

- Corporate and structuring advice;

- Financial and taxation due diligence;

- Valuations; and

- Company shareholder tax advice and planning.

Learn more about our corporate advisory expertise.