Against the backdrop of rising interest rates, rising inflation and geopolitical uncertainty, there was a significant decrease in the number of IPOs in the second half of 2022, notably in the technology sector.

From mid 2020 to early 2022, investors showed support for companies operating in sectors that flourished during the COVID-19 pandemic including ecommerce, pharmaceutical, food delivery, cloud technology solutions and technology services. They benefited from increased demand for products and services that could be accessed from the home or that supported remote working arrangements.

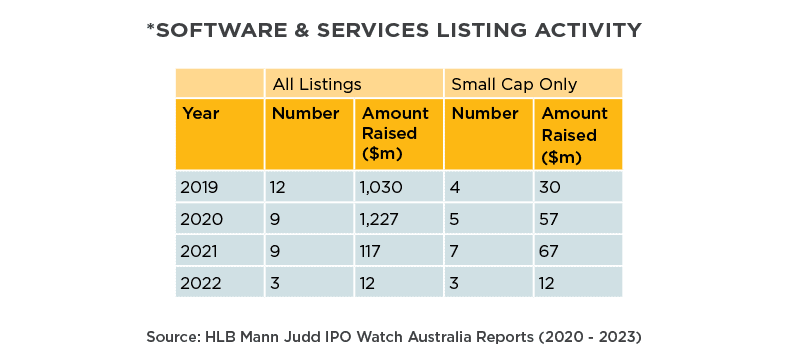

New listings in the tech sector dropped considerably in 2022, as noted in the table below.

While the ASX has taken considerable steps in recent years to attract local tech IPOs, including allowing dual listings on other global exchanges, there were several macro factors impacting tech company listings on the ASX which may continue into 2023, including:

- Global compression on the valuation of listed and unlisted tech-related businesses, following historic highs in 2021.

- A perception of uncertainty for growth stage businesses to raise on-going capital to fund future growth and development.

- General cyclical pressure on technology companies in times of higher inflation and interest rates.

While capital raising via an IPO may be challenging for tech companies in the near term, it remains a viable option for the future. The ASX has favourable listing rules (compared to some overseas exchanges) for pre-revenue businesses. Investors in the market also have a history of investing in yet to be proven companies as observed by the continued support of listings in the Materials sector.

For tech companies considering other options, there remains a significant amount of undeployed capital in the private markets. It can be accessed through venture capital funds, private equity, family offices or institutional funds.

In addition, we anticipate an increase in M&A activity over the next 12 months. In the current environment, a number of companies are seeking to acquire or partner with other companies rather than build. HLB Mann Judd’s most recent Australian M&A Review reported that Information Technology was one of the top three sectors by the number of deals in Q1 FY2023.

Early-stage venture capital investment in Australia is supported by a number of Federal and state funded programs which encourage investment in emerging and earlier stage businesses by providing incentives and tax exemptions to investors. The programs include the Early Stage Innovation Company (ESIC), Early Stage Venture Capital Limited Partnerships (ESVCLP) and Venture Capital Limited Partnership (VCLP). Typically these schemes can make available upfront tax offsets to investors, along with reducing the potential future capital gains tax that may be payable on the exit of an investment.

According to venture capital industry data released by the Australian Government, the statistics indicated that investors via these schemes have funded and supported a number of technology-backed businesses in Australia.

Australia has a maturing venture ecosystem, with an expanding array of talented and experienced entrepreneurs, professionals, programs and facilities to nurture the expansion of innovative technology businesses.

The continued local funding and support for early stage innovation companies will support a pipeline of new opportunities for future Australian IPOs.

*Analysis excludes technology-backed businesses classified under the Diversified Financials and Health Care Equipment & Services sectors. This article was first published in the 2023 IPO Watch Australia Report.