With the proposed Fringe Benefits Tax (FBT) exemptions – and fuel prices continuing to rise – now might be an opportune time to consider an electric vehicle.

As part of the last Federal Election campaign, Labor’s policy platform included measures to reduce the cost of electric vehicles including hydrogen fuel cell electric cars and plug-in hybrid electric cars.

The proposed exemptions will be available for eligible electric vehicles, which are electric vehicles purchased under the Luxury Car Tax (LCT) threshold for fuel efficient vehicles ($84,916 for the 2022/23 financial year) and made available for use after 1 July 2022.

The exemptions include:

- Removal of the five per cent import tariff for eligible electric vehicles; and

- FBT exemption for eligible electric vehicles.

While the LCT threshold for fuel efficient vehicles somewhat limits the number of vehicles the proposed exemptions apply to, there are still over a dozen eligible vehicles in the Australian market.

The import tariff will incentivise electric vehicle manufacturers to import affordable vehicles into Australia and may even result in more eligible vehicles.

The FBT exemption provides a significant benefit to employers and employees. Once enacted, employees could, where available, enter a valid salary packaging arrangement and pay for the electric vehicle pre-tax and have no post-tax contribution to cover the benefits. Employers could consider providing electric vehicles to their employees as part of their salary package to attract and retain employees.

It is important to note that Labor’s policy platform did not indicate if these exemptions would extend to second hand vehicles or novated leases.

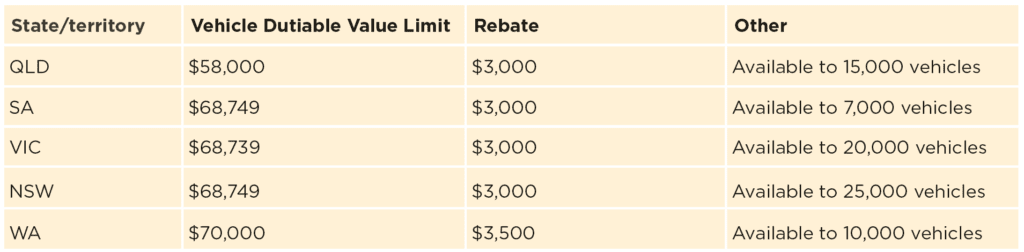

While the proposed federal exemptions look to move Australians to electric vehicles, many states have taken steps to promote the uptake of electric vehicles through rebates and stamp duty exemptions/reductions. Some of the key rebates are as follows:

With all the rebates, subsidies, proposed exemptions, and rising fuel costs, now may be the perfect time to start looking for an electric vehicle that is right for you and your business. It is also a great time for employees in the market for a new car to consider entering into effective salary packaging arrangements to maximise their after-tax income.

Authored by Christopher Pedler, Business Advisory Supervisor, Brisbane.

This article was first published in the Spring 2022 issue of Financial Times.