Strong activity off the back of an 'interesting' year

Following the economic recovery from the COVID-19 pandemic, access to cheap capital, built-up cash reserves and other macroeconomic factors, Australia’s merger and acquisition (M&A) activity had an ‘interesting’ year.

FY2022 M&A Report Summary

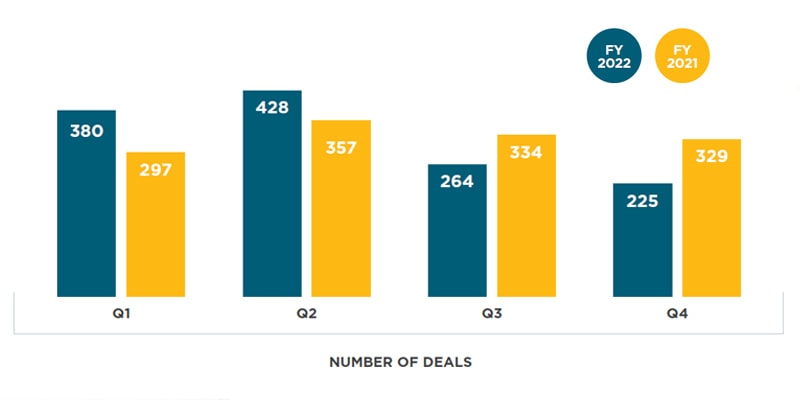

- There was a slight decrease in deals since FY2021 from 1317 to 1297

- Rising global political tension and higher inflation saw a decline in deals in the second half of the year

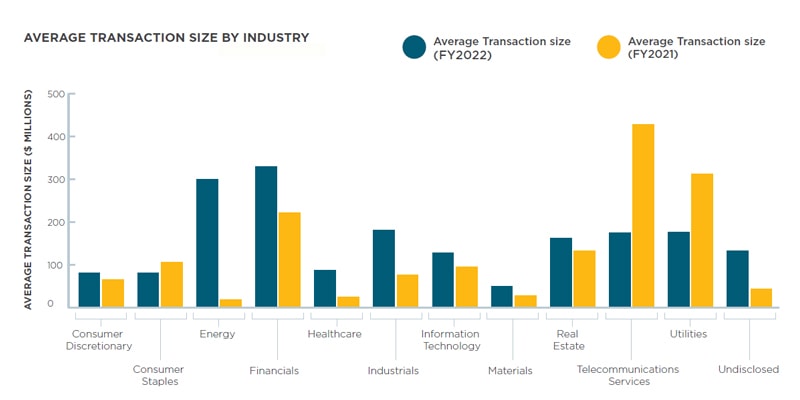

- Average transaction size was significantly higher in the energy (up 1,773%) and healthcare (up 285%) sectors

- Venture capital and private equity firms are likely to be the strongest buyers

- With the growing trend toward being seen to be greener, buyers are asking tougher questions about environmental, social and governance (ESG) compliance

About the M&A Annual Report

The M&A Annual Report highlights key deals that happened in the last 12 months as well as insights as to what the year ahead holds for transactions.

This year's M&A Annual Report analyses deal volume, pricing and industry activity, as well as providing an overview of deal activity in the SME space and highlighting some of the deals the HLB Mann Judd Sydney advisory team assisted with.

Meet Simon James, Sydney Advisory partner and co-author of the report

How HLB can help

We offer a comprehensive range of professional services to clients who wish to buy or sell a business. Most recently we have been involved in the successful sale or merger of businesses in the retail, engineering, IT, freight forwarding and industrials sectors. Some of the ways we support our clients include:

- Getting 'transaction ready'

- The sales process

- Due diligence

- Valuation

Learn more about how we support our clients at each stage of the business life cycle.