As interest rates are increasing, investors are getting excited about the ‘risk-free’ returns that are available. Advice from our wealth management team is that investors are asking about moving away from traditional Australian share investments, into term deposits or other similar interest yielding instruments.

It is important to also understand the ‘after tax’ returns when considering an investment. For example, consideration needs to be given to the tax outcomes of interest returns, compared to the tax outcome of returns on Australian share investments. Particularly, consideration of franking credits that are available on income returns that come from a share investment, and additionally, the capital gain tax discount that may be available on any capital appreciation of the share price.

Franking Credits

Australia is one of the few countries which has an imputation system, otherwise known as the franking credit system. Broadly, this system allows for any income tax which has been paid by a company to flow through and be available as a refundable tax credit for an investor. In addition to the cash dividend an investor receives a franking credit. Not all dividends have a full tax credit attached, however, most regular dividends from the top end of the ASX are fully franked.

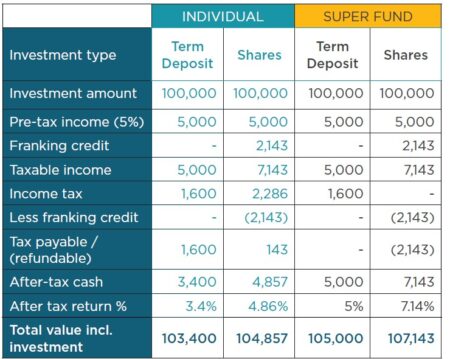

If we take an investment of $100,000 in a term deposit, which contains a 5% interest yield, compared to a similar investment in a big for bank, returning say 5% on dividends, yield the after-tax outcome differs when franking credits are considered.

The following table compares an individual investor with an average tax rate of 32% and a superfund in pension with a 0% tax rate. For simplicity compounding of returns is ignored.

Comparing the analysis in the table, the after-tax return on shares is considerably higher when the starting point is the same income yield. Accordingly franking credits can be considered a form of income for the investor.

Capital Gains

In addition to the varying tax outcomes on income returns, there are also different tax outcomes on capital appreciation to consider. An investment in shares is a CGT asset and any increase in the value of the shares may be eligible for a discount of up to 50% when sold. It is generally unlikely that instruments, such as term deposits, will have capital appreciation.

However, some interest yielding investments may, if they are tradable, and where this applies, any return on these interest yielding investments, would not be eligible for the CGT discount. Accordingly, any after-tax cash from the realisation of the investment is generally higher for share investments.

Conversely, capital losses are only able to be offset against capital gains. If a loss is made on a revenue asset these losses can be applied against all other income, including net capital gains.

Take away

The return on investment is an important consideration when deciding a balanced portfolio of investments. It’s important to consider not only the cash return but also the income tax considerations that cause a differing after-tax outcome.

This article was first published in Personal Wealth Adviser, Issue 6.