New legislation is proposing for the Taxable Payments Reporting Scheme to be extended to operators of electronic distribution platforms (EDP) so that they are required to report sellers using their platforms and their payment information to the ATO.

The Taxable Payments Annual Reporting Scheme is an industry specific reporting obligation that has targeted those industries operating in the black economy including building and construction, road freight, cleaning, IT, security services and the courier services industries. As Australia’s sharing economy has continued to grow, a transparency gap has developed because current tax reporting systems do not adequately capture information about transactions in this part of the economy. As a result, the ATO is concerned there is a risk that Australians selling on platforms such as Airtaskter, Uber and AirBnB are not paying their fair share of tax.

Who is required to report?

Once the bill is enacted, the reporting regime will apply to platforms providing the supply of taxi travel and supply of short-term accommodation from 1 July 2022. Platforms providing the supply of asset sharing, food delivery, task-based services and other supplies will be subject to reporting from 1 July 2023. Generally, the supplies to be captured will include any form of supply, including the supply of goods, services, real property, advice and information however will exclude the following:

- Where only the title of goods are exchanged

- Financial supplies, (financial securities trading)

- Transfer of ownership of real property

- Where subject to certain withholding requirements

- Where the seller is the operator of the platform (under a reseller model).

Transactions that involve the lease of goods or real property that are made through EDP will be captured by the reporting regime. All supplies purchased through an EDP must also be a supply connected with the indirect tax zone – this is taken from GST concepts to broadly mean goods that are delivered in, made available in or removed from the indirect tax zone.

What information will be reported?

The seller’s identification information that may be reported include legal name, date of birth, primary address, bank account details, ABN, telephone, and email details.

The transactional information that may be required includes total gross payment to seller, total net payments to seller, GST on the gross payments, fees and commissions withheld, GST on total fees and commissions, property address if related to rental real property and period for which property was booked during the reporting period. When making these disclosures to the ATO, platform operators will need to ensure that it does not provide information outside of these requirements to ensure it is complying with the Australian Privacy Act 1988.

What happens if the EDP providers do not comply?

If the TPAR is not lodged on time, impacted EDP providers may be subject to Failure to Lodge penalties of up to $555,000 if a Significant Global Entity (SGE). Regardless of the EDP provider’s income year, the report must be prepared on a 30 June year end basis and is due 28 August of that year. The first reporting year will be the year ended 30 June 2023 and due 28 August 2023.

Now that the ATO have this information, what happens if the sellers do not report its earnings?

The ATO will use this information in two ways:

- collect this information to put income information into the online tax returns of sellers; and

- to identify sellers who are not meeting their tax obligations.

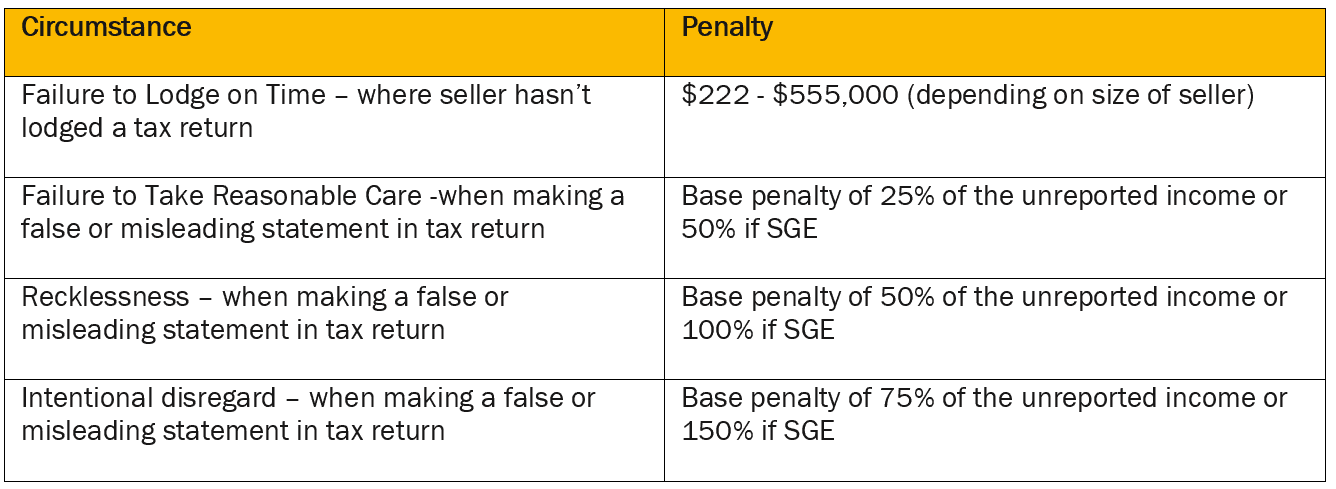

If the ATO identify sellers who have not reported their earnings, these sellers may be subject to penalties depending on their circumstance as follows:

If you have any questions on preparing a taxable payments annual report or whether your business might be captured, please reach out to your HLB adviser.

This article was co-authored by Irene Collins, HLB Mann Judd Sydney Manager.