Federal Government Proposed Legislative Changes to Support Businesses Impacted by Lockdowns

On 15 July 2021, the Prime Minister announced the Commonwealth would facilitate the administration of COVID-19 business support payments for States and Territories. The Treasury Laws Amendment (COVID-19 Economic Response No. 2) Bill 2021 (Bill) was introduced into Parliament on 3 August 2021 and is currently before Senate and is expected to be passed and receive Royal Assent shortly

Changes for Businesses

The Bill allows the Federal Government to treat Coronavirus Economic Response Payments, such as the 2021 COVID-19 Business Support Grants for lockdown-impacted businesses in Queensland funding, as non-assessable non-exempt (NANE) income. These amendments change the usual treatment that treats such payments as assessable income.

For the government payments to be NANE income, the payments must be to support business impacted by State or Territory lockdowns and health orders seeking to stop the spread of the COVID-19. Entities are eligible for this concessional tax treatment if:

- the payment was made under a program administered by the Commonwealth;

- the payment is received in the 2021-22 financial year; and

- they carry on a business and have aggregated turnover of less than $50 million.

Changes for Individuals

Individuals will also be able to treat payments received under the Commonwealth COVID-19 Disaster Payment scheme as NANE income once the Bill receives Royal Assent. These payments are being made by Services Australia and are NANE income where they satisfy the definition of “COVID-19 Disaster Payment” under the COVID-19 Disaster Payment (Funding Arrangements) Act 2021. Broadly this definition includes payments to eligible individuals under the COVID-19 Disaster Payment scheme that live or work in hotspot areas and have their income affected by COVID-19 restrictions.

The amendment to the tax treatment of the Commonwealth COVID-19 Disaster Payment is proposed to come into effect from 1 July 2021 and will end once the payment scheme ends.

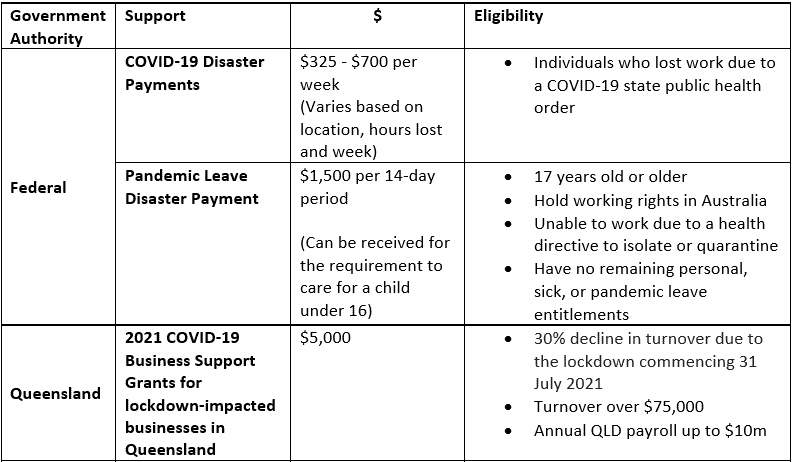

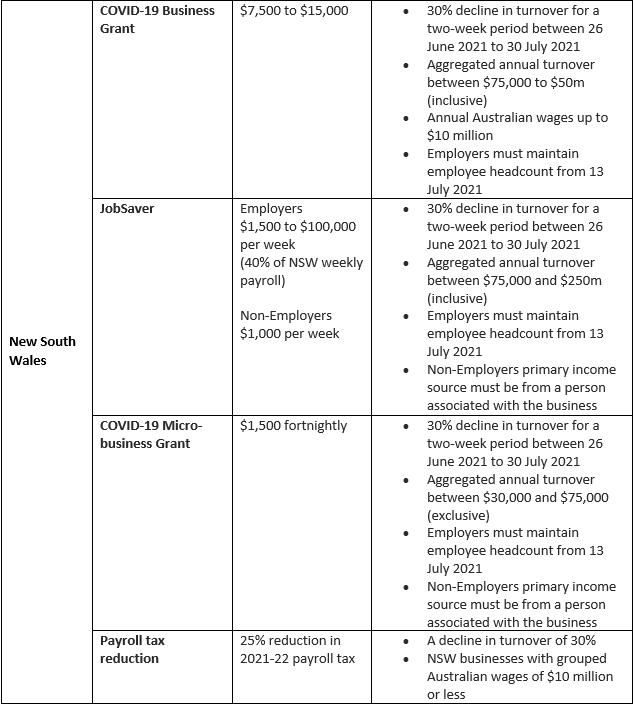

State and Federal COVID-19 Relief Payments

The Federal and State Governments have released several support packages throughout the COVID-19 pandemic to support businesses and individuals impacted by lockdowns and restrictions. The current significant Federal, Queensland, New South Wales and Victorian Government support initiatives have been summarised below:

Please note that at the time of preparing this summary the Victorian Government had not announced any additional support for businesses or individuals impacted by the lockdown commencing on 5 August 2021.

Further Information

For more information on the proposed legislation changes or on the support available for individuals and businesses impacted by COVID-19 please contact our office.